Episode 2Expect Market Volatility While Building Wealth

Market corrections are painful yet inevitable. Understanding this can help you stay invested to benefit from the power of compounding.

Share this Video

Transcript

| Speaker | Timestamp | Statement |

|---|---|---|

| Morgan Housel | 00:00 | The difference between a fee and a fine is subtle, but it's really important. |

| Morgan Housel | 00:04 | A fine means you did something wrong. You're in trouble. Shame on you. Here's your punishment. Don't do it again. You get a speeding ticket, you're in trouble. That's a fine. |

| Morgan Housel | 00:12 | A fee is just the cost of admission to getting something good on the other side, that you are willing to pay because it's worth it to get through. You're not in trouble because it's the cost of admission. |

| Morgan Housel | 00:20 | Most investors intuitively interpret volatility as a fine when, instead, they should be interpreting it as a fee. If their portfolio were to decline 20 or 30%, they view that as an indication that they did something wrong, that they're in trouble, that they made a mistake, when the huge majority of the time, that's not the case. They are experiencing the fee of investing, the cost of admission to doing well over time. |

| Morgan Housel | 00:43 | We know that markets can provide good long-term returns, but nothing good in life is free. Everything worthwhile pursuing has a cost of admission attached to it. In investing, that cost is putting up with and enduring a never-ending chain of uncertainty and volatility and ups and downs and booms and busts. |

| Morgan Housel | 01:02 | I think just that subtle mindset shift of when you're enduring volatility to think, look, look, it's not that I screwed up. It's not that my advisor screwed up. This is not a fine. This is just the bill coming due to earning good long-term returns over time. Just like if I were to go to Disneyland and you pay a hundred or $200 at the gate, whatever it is these days, you're not in trouble. You just know that it's worth it to get to the other side. |

| Morgan Housel | 01:24 | Now, the mistake a lot of investors make is that rather than viewing it as a fee that is worth paying, a cost of admission that's worth paying, they want to avoid the fee. They want the returns without the volatility. They want to sneak into Disneyland. They want to jump over the fence and get in. |

| Morgan Housel | 01:40 | I think a big insight for investors, for long-term investors, is understanding that the fee is worth paying. The cost of admission is worth it. If you can put up with a never-ending ceaseless chain of volatility and surprises and stick around for 10, 20, 30, 40, 50 years, it is so worth it to pay that fee. The rewards compensate you and then some. |

| Chris Davis | 02:02 | Well, I'll even build on that by saying if we think of that fee as the cost of admission, I would say that there's a door prize, an option that is stapled to that door, to that admissions ticket. That is if you can wire yourself to see the volatility not as a fee, but as an option to actually increase returns over time- |

| Morgan Housel | 02:29 | No. |

| Chris Davis | 02:29 | ... by recognizing that that volatility can actually serve you. Now, that is a far bridge for a lot of investors to get to, but that idea that, wow, that boom in that bust actually could serve me. So in addition to paying this fee, I've actually got a door prize where I have a chance to take advantage of the volatility, which people perceive as a fine. They should see it as a fee. |

| Chris Davis | 02:57 | But even better, they could see it as an option to enhance returns by recognizing that people will tend to overreact in those periods. You'll never pick the bottom, you'll never pick the top, but feeling generally more positively disposed when the volatility is all on the downside and generally more restrained when the volatility is all on the upside, that is a way to get a refund and actually a return on your cost of admission. |

| Morgan Housel | 03:02 | I love it. |

Chris & Morgan Bios

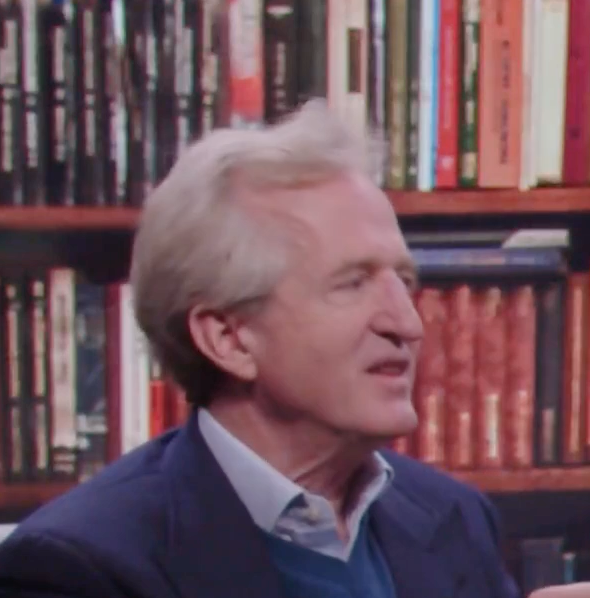

Chris Davis

Chris is Chairman of Davis Advisors, an independent investment management firm founded in 1969 with approximately $26 billion in AUM. As of 9/30/24 He’s co-portfolio manager of the Davis NY Venture Fund as well as other portfolios focused on Large Cap and Financial companies across mutual funds, SMAs and ETFs. Chris has over three decades of experience in investment management and securities research, was recognized as a Morningstar Manager of the Year and sits on the Board of Directors for Berkshire Hathaway.

Morgan Housel

Morgan is a partner at The Collaborative Fund and serves on the board of directors at Markel Corp. His book The Psychology of Money has sold over two million copies and has been translated into 49 languages. He’s won multiple awards and accolades for his writing and insights from the Society of American Business Editors and Writers, the New York Times, and other industry organizations. Morgan has presented at more than 100 conferences in a dozen countries.