Episode 10Pulling It All Together – Mastering the Mental Game of Investing

Concise review of the most critical insight of this series: Your mindset and behaviors towards investing, spending and volatility can determine whether you reach your goals.

Share this Video

Transcript

| Speaker | Timestamp | Statement |

|---|---|---|

| Chris Davis | 00:00 | Morgan, at our firm I think I've spent 30 years trying to talk about the relationship between the returns an investor gets and the behavior of that investor. In other words, that end return is the product, both of the return of the underlying investment and then their behavior, the timing of their decisions, whether they get scared out, whether they chase high prices in. |

| Chris Davis | 00:26 | And we've recognized that in working with financial advisors, that so much information is always provided about the investment return of the underlying asset or fund, and almost nothing about investor behavior. So for 30 years, we've been trying to talk about all the futility of forecast, the inevitability of bear markets and recessions and the importance of resilience. And then I read your book and there it all is distilled into 20 chapters, all of what we've been trying to say in 20 years. |

| Chris Davis | 01:02 | I'd be curious if you wanted to take that distillation and boil it down to an investor who's listening to us now, is thinking about how to communicate the importance of investor behavior, the importance of how they think about money, how they think about savings, to distill that down into just a few minutes in order to get them at least hooked on the idea that they've got to come in and learn more to understand why this is so important. |

| Morgan Housel | 01:34 | I think, Chris, one big part of this is actually the first chapter of the book, is that we are all shaped by our individual experiences. And since all of our experiences are different, no two people have the same view of how the world works and therefore what's the best thing to do with their money. So I think one of the most important parts here is just becoming introspective about who you are and what is your risk tolerance? What are your goals? What is your view of the world? Even if people around you were just as smart as you, just as educated as you, have the same information, are coming to different conclusions. If it works for you and it's working for you and it's making you happy, do it, that's the right answer. There's no one right answer in terms of how to invest or how to spend your money, how to save your money. |

| Morgan Housel | 02:11 | Everyone comes to different conclusions, and that is okay. So viewing finance as a very personal endeavor is really critical. I think it's probably the most critical aspect that gets overlooked in this world. The other thing is using your money to gain control over your time and independence and freedom and autonomy over the endless pursuit of more stuff. And a big part of that is, as you mentioned earlier, is making sure that your income grows faster than your expectations. If your expectations grow faster than your income, you will never be happy with your money. And so much focus in the industry, and so much intuition when people think about this, is how can I get more money? What's the best amount of money that I should have? It's more than I have today. That's the view that tends to persist. |

| Morgan Housel | 02:57 | And it's not that that's wrong. It's just that you have to match the amount of money that you have with your expectations and realize that all the happiness you will get from money is the gap between what you have and what you expect. It's the gap between the two that makes people's jaws hit the floor. That's what they are really going after. That's really critical. And in the investing world, I think nothing matters more than understanding that volatility is a cost of admission, not an indication that you did something wrong. And that rather than trying to avoid it and thinking of ways that you can avoid the volatility and never experience it, viewing it as something that you should welcome. That is the cost of admission to doing well over time. And when you are experiencing it, realizing that you are just paying the bills rather than you are being scolded for doing something wrong, by far and away is the most important aspect of investing. I'd say those three points are what matter most to me, when I think about this topic. |

| Chris Davis | 03:46 | And they really are the bedrock, that investor behavior and the influences on it. And I think as we tune that idea to the role that a financial advisor plays, it's how they modify and influence that behavior rather than exacerbate or amplify it. And I think that their, I like to quote my wife, who says that the secret to a happy marriage is low expectations, because setting expectations, as you say, the gap between expectations and returns matter so much in terms of an individual's perception of their own wealth, but it also matters in terms of that advisory relationship. Setting the expectation in a way that you can achieve for that client what you are in essence promising them, which is you can't promise them a number. You can't promise them a return. What you can promise them is that they're going to be investing through a recession. They're going to be investing through a bear market. They're going to be investing through inflation. And they're going to be investing through a boom and through a bull market and through falling interest rates. |

| Chris Davis | 04:56 | If you can set their expectation of what is the inevitability of these both positive and negative parts of a market cycle, set their expectation that trying to predict the timing of these things and reacting to forecasts is a futile and self-destructive sort of tendency. And then I would even say over-indexing to negativity. If you can help moderate the very human tendency to over index to negativity, your phrase, which is save like a pessimist and invest like an optimist, I think if I was to distill it all down, for me, that's one of the most important mindsets to get out there. And it's distilled in a way that really is actionable and I think invaluable. |

Chris & Morgan Bios

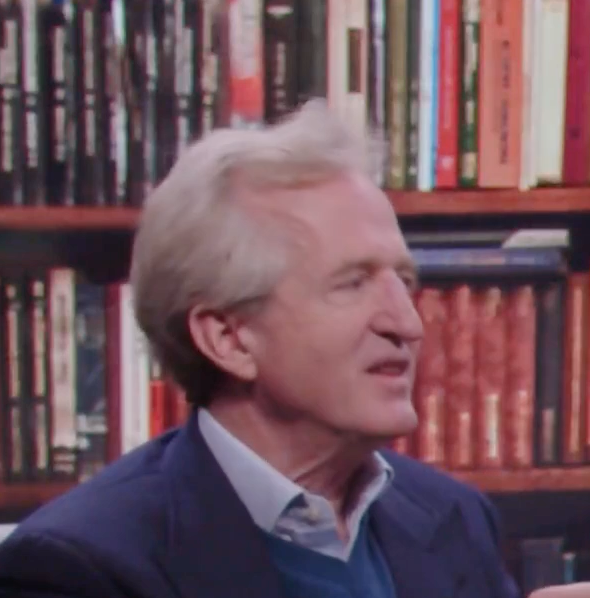

Chris Davis

Chris is Chairman of Davis Advisors, an independent investment management firm founded in 1969 with approximately $26 billion in AUM. As of 9/30/24 He’s co-portfolio manager of the Davis NY Venture Fund as well as other portfolios focused on Large Cap and Financial companies across mutual funds, SMAs and ETFs. Chris has over three decades of experience in investment management and securities research, was recognized as a Morningstar Manager of the Year and sits on the Board of Directors for Berkshire Hathaway.

Morgan Housel

Morgan is a partner at The Collaborative Fund and serves on the board of directors at Markel Corp. His book The Psychology of Money has sold over two million copies and has been translated into 49 languages. He’s won multiple awards and accolades for his writing and insights from the Society of American Business Editors and Writers, the New York Times, and other industry organizations. Morgan has presented at more than 100 conferences in a dozen countries.