The International Opportunity

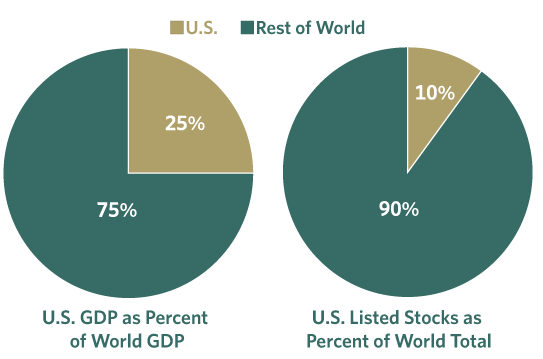

Vast Opportunities Exist Outside U.S. Borders1

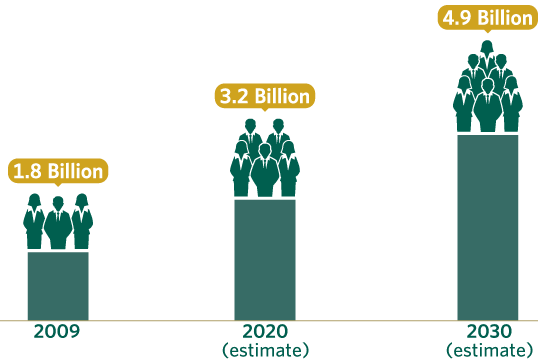

Global Middle Class is Growing2

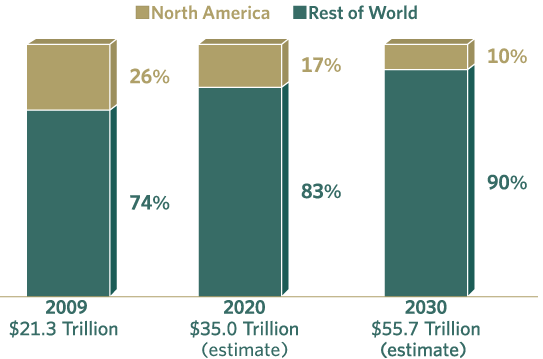

Global Middle Class Spending is Rising3

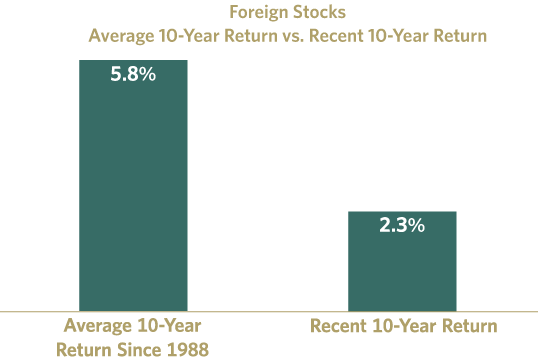

Foreign Stocks Have Lagged4

The Global Investment Landscape

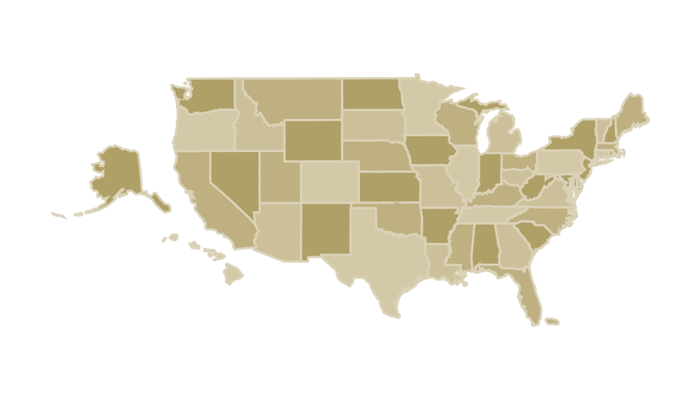

United States

- Favorable conditions: low inflation, low interest rates, relatively full employment, moderate growth.

- Current valuations and margins favor investing selectively.

- Opportunities include both wide-moat businesses with room for margin expansion and earnings growth and select out-of-favor businesses with strong prospects.

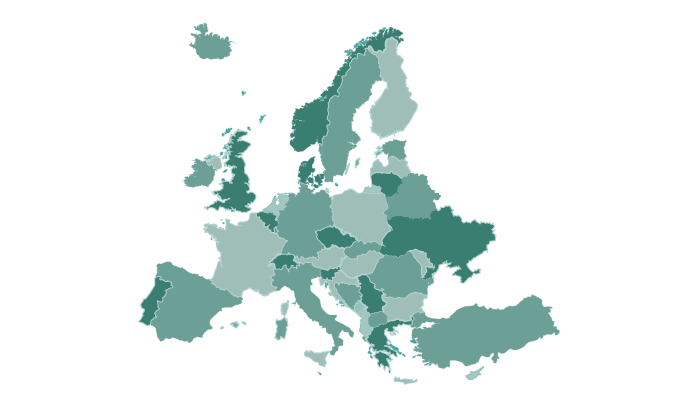

Europe

- Continues towards recovery from the financial crisis.

- Opportunities include premier multinational leaders with strong, long-term global growth prospects.

- Avoid companies with tepid growth tied solely to the European region.

Emerging Markets

- Attractively valued, but opportunities and risks vary widely by country.

- Opportunities include companies increasing market share in enormous and fast growing economies such as China and India and industry-dominating businesses in Brazil.

Investment Themes

Rise of the Online Consumer Worldwide

- The number of internet users has doubled since 2010 to 3.5 billion and is growing at 10% per year.5

- A vast opportunity exists in the years ahead: Global online purchases are growing at 17% per year, yet account for only 7% of total retail sales worldwide.6

- Many of the best opportunities for investing in this theme are international, as 75% of online purchases occur outside the U.S.7

- Beneficiaries include Amazon, JD.com, Naspers and Alibaba.

Expansion of Global Transportation

- The movement of people and products worldwide is accelerating because of the expansion of world trade, the emerging global middle class, and the proliferation of the Internet worldwide.

- The world's transportation infrastructure has not kept pace with rising demand. For example in India, there are currently fewer than 500 commercial passenger aircraft for 1.2 billion people.8

- Beneficiaries include InterGlobe Aviation, ZTO Express and Safran.

Boom in College-Prep Education in Asia

- College admissions in Asia is hyper-competitive, with large numbers of students competing at early ages for a finite number of spots.

- In China, 200 million students in grades K-12 will compete for admission to top universities, with only a 3% acceptance rate versus 28% in the U.S.9

- Beneficiaries include: New Oriental Education & Technology, and Tarena International.

Putting These Ideas to Work

Davis Select International ETF (DINT):

High-conviction, best ideas portfolio

Non-U.S. companies in both developed and emerging markets

Benchmark Agnostic

Seeks to outperform the index, not mirror it

Low expected turnover and a strategic, long term time horizon

Our long-term focus allows investments to compound

Traditional benefits of ETFs:

Low cost, tax efficient, intra-day liquidity and transparent

Davis Select Worldwide ETF (DWLD):

High-conviction, best ideas portfolio

Invests in the US and abroad, in both developed and emerging markets

Benchmark Agnostic

Seeks to outperform the index, not mirror it

Low expected turnover and a strategic, long term time horizon

Our long-term focus allows investments to compound

Traditional benefits of ETFs:

Low cost, tax efficient, intra-day liquidity and transparent