Mastering the Mental Game of Investing

A video series to help you develop the mindset of a successful investor.

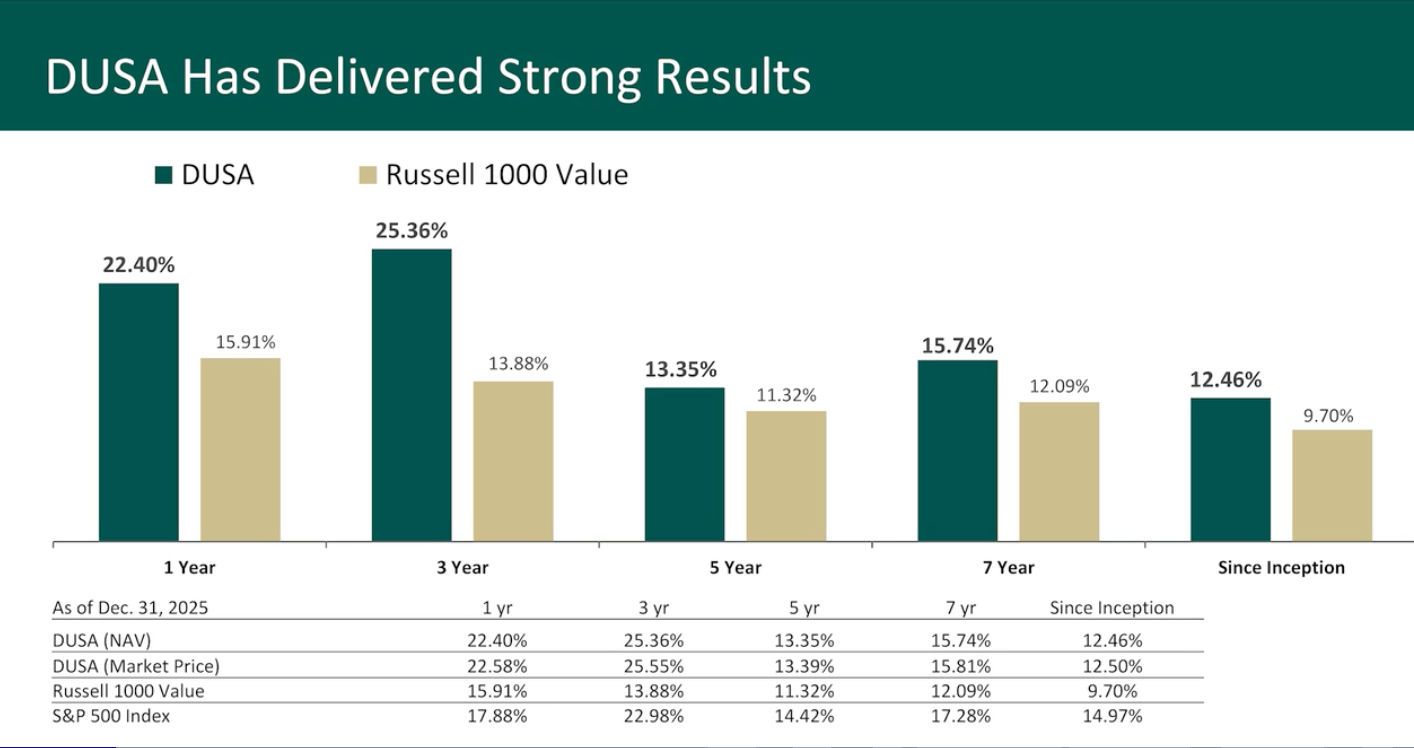

Watch the SeriesUnpacking DUSA’s Top Performance in 2025

PM Chris Davis on what has helped Davis Select US Equity ETF (DUSA) become one of the top active ETFs in the industry.

Watch Now

PM Chris Davis with David Rubenstein of Carlyle Group

Why all true investing is value investing, the importance of patience, resisting momentum-driven markets, maintaining discipline through volatility.

Watch Now

Stewardship, Patience and Going Against the Crowd (3:59)

Chris Davis and Bill Miller reflect on 40 years of friendship and how temperament has impacted their respective investment styles

Watch Now

Navigating Today’s Volatility (3:52)

Why experience teaches that “You make most of your money in a bear market, you just don’t realize it at the time”

Watch Now

Tariffs, Geopolitics and the Fallacy of Forecasts (3:50)

Markets overreact in the face of uncertainty. Our economy, businesses and markets are dynamic and will adapt – a huge strength

Watch Now

Amazon, GE and What to Look for in a Business (3:53)

How a company management can create or destroy business value over time

Watch Now

Free Cash Flow Yield as a Measure of Value (2:13)

The insight that this obscure statistic can reveal about the valuation of a business

Watch Now

The Invaluable Role of the Advisor (1:55)

How an advisor can help guide clients’ perspective in good markets and bad, fostering the successful compounding of wealth

Watch Now

What Gets You Excited About the Next Decade? (2:49)

Beyond the growth expected via breakthrough technologies, the low prices produced by uncertainty should excite every rational investor

Watch Now

AI: Separating Hype from Opportunity (4:17)

Why the leaders of any tech revolution do not always end up the winners – No one can dictate outcomes and adaptability will be key

Watch Now

Why Cash May Not be King (1:45)

Being on the sidelines may feel safer, but over the long term inflation destroys cash’s purchasing power while equities build true wealth

Watch Now

Investing through Volatility

PM Chris Davis on developing a mindset that allows you to tune out the daily drama and successfully build wealth.

Watch Now

Surprising Growth in Active ETFs (2:30)

Widespread adoption of active ETF strategies, as investors reach beyond index investing

Watch Now

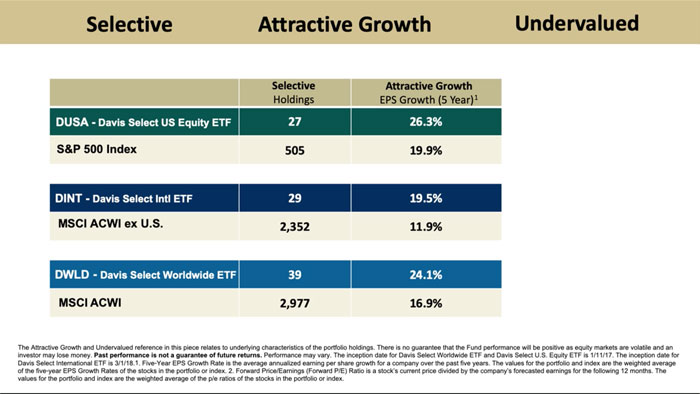

Four Active ETFs from Davis (2:55)

Overview of our 4 ETF strategies, providing access to the Davis investment discipline with the conveniences of the ETF structure

Watch Now

What Drives Stock Selection in the Davis ETFs’ Active Strategies (1:31)

The basic question our PMs ask: “What kind of businesses do you want to own, and how much do you want to pay?”

Watch Now

A Closer Look inside DUSA (6:09)

Dodd Kittsley, CFA & Davis Director of ETFs, discusses investment themes, types of companies, and the attractive growth / low multiple companies populating the portfolio

Watch Now

Incorporating DUSA in a Portfolio Allocation (1:44)

How investors are using DUSA, the types of managers we pair well with in a diversified portfolio allocation

Watch Now

The Most Important Things We Believe Equity Investors Should Focus on Today (6:18)

Why we believe selectivity is more important in a time of great market and economic transition and highs in both market concentration and valuations

Watch Now

Rigorous Research & Selectivity are Critical in Today’s Market (2:14)

Why we’re focused intently on identifying resilient companies with above average growth prospects - and not overpaying

Watch Now

The Attributes We Believe Investors Should Seek When Selecting an Investment Manager (2:25)

Look for the same characteristics in an investment manager that you'd look for in a company: a track record of execution, resilience, adaptability to change

Watch Now

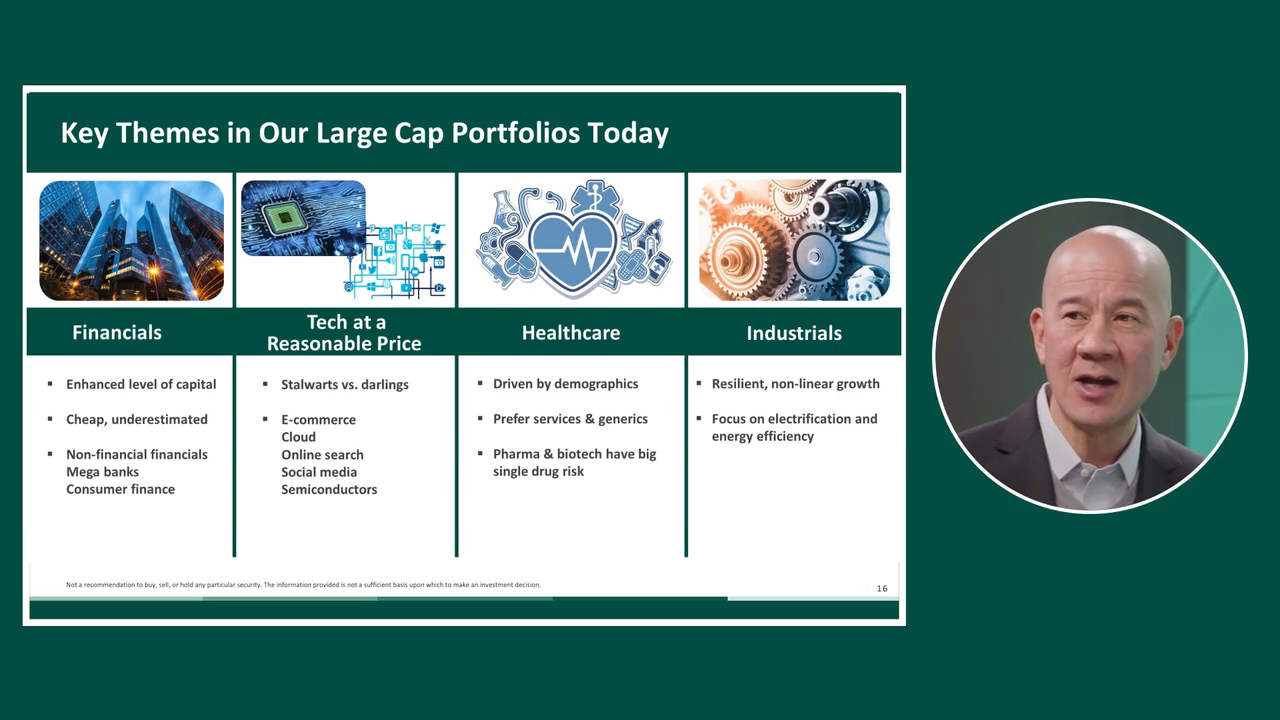

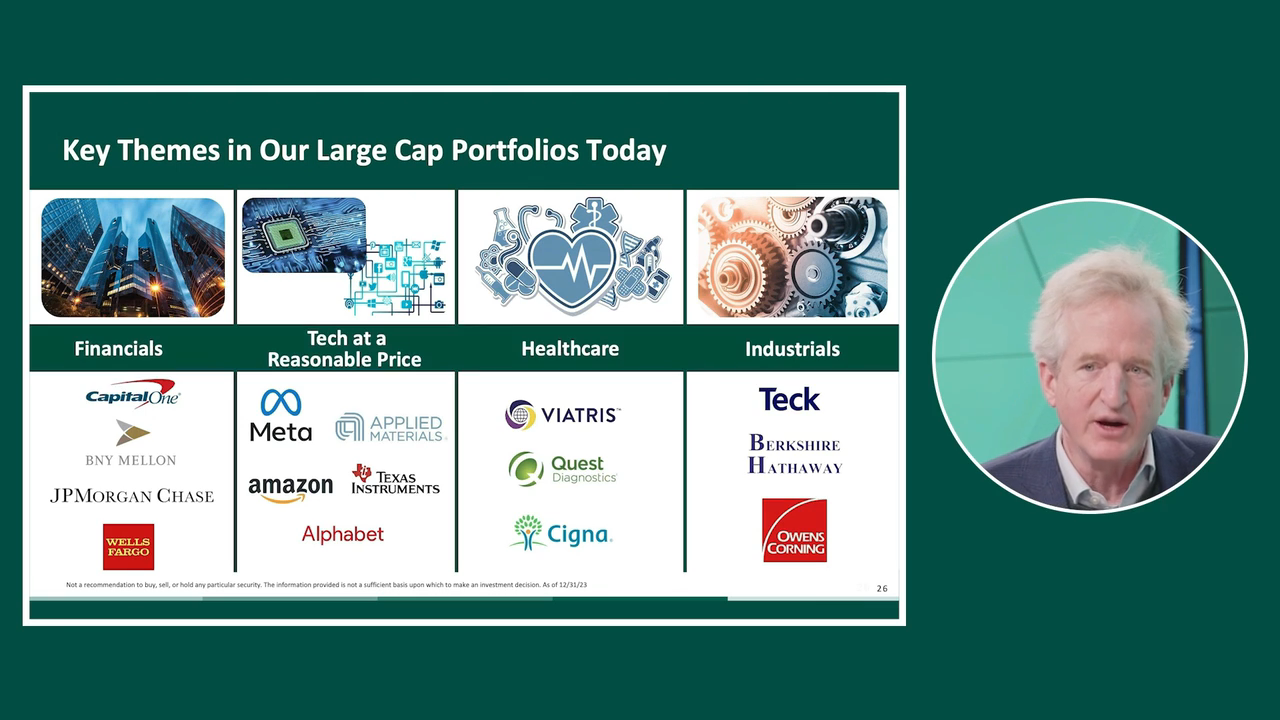

Investment Themes in the Portfolio Today (1:53)

Why we see tailwinds and opportunities across Financials, Tech, Healthcare and Industrials

Watch Now

The Danger of Overly Aggressive Growth Assumptions (1:30)

Why investors often overpay for the inflated growth projections of today's high flyers - taking on risk in the areas they see as safe

Watch Now

Undervalued & Underappreciated – The Opportunity Today in Select Financials (4:05)

Why the best-run Financials continue to be significantly undervalued, as investors misunderstand their durability and earnings power

Watch Now

Uncovering Opportunities in the Tech Sector (3:35)

How we navigate the Technology sector, identifying companies with durable, growing earnings and avoiding the lofty valuations of "story stocks"

Watch Now

Having the Courage to Go Against the Crowd – A Closer Look at Our Investment in Meta (3:27)

Passive management often buys what's gone up and sells all the way down. Active managers can add real value by doing rigorous company research and bucking the consensus view

Watch Now

Opportunities in the “Picks & Shovels” of the Tech Sector (1:26)

Identifying the great, but out-of-the spotlight companies that support the current tech revolution

Watch Now

Separating Hype from Opportunity – Investment Implications of AI (4:44)

How we're thinking through transformational growth opportunities, along with the risk of the over-hyped companies and soon-to-be obsoleted business models

Watch Now

“Value Creators and Price Takers” - Investing in Healthcare Today (4:42)

Why we don't bet on blockbuster drug approvals - focusing instead on durable companies that are helping to manage costs across the healthcare system

Watch Now

“Hey ChatGPT – Finish this Building…Oh Wait!” Opportunities in the Industrial Sector (2:25)

Don't forget opportunities in the real physical world of commodities, agriculture and building products, far from today's over-hyped story stocks

Watch Now

Electrification, Teck Resources & the Supply / Demand Mismatch in Copper (3:25)

How companies like Teck Resources are helping to meet the challenges of building out electrical capacity in a transitioning world

Watch Now

Predicting vs. Preparing, Navigating Sticky Inflation & High Valuations (4:19)

In a world of significant transformation, it's not about risk on / risk off. It's about aligning with durable, adaptable, growing businesses and not overpaying

Watch Now

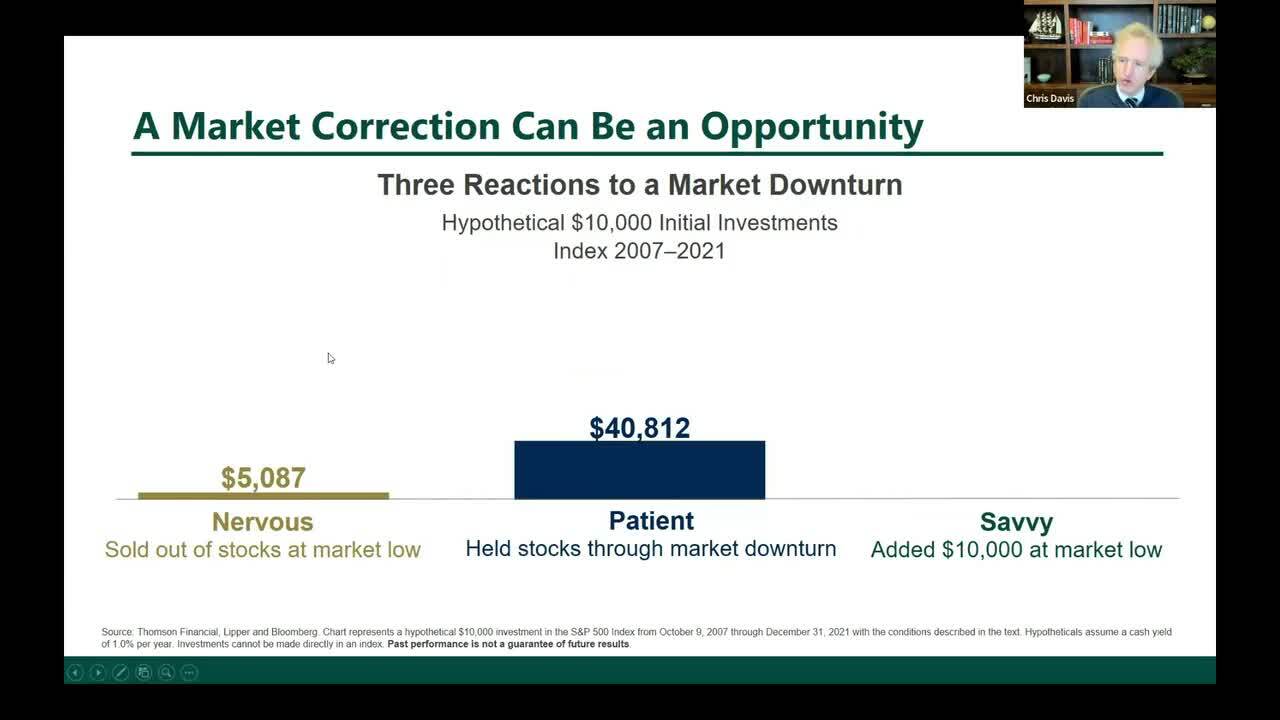

Strategies to Mitigate the Investor Behavior Penalty (3:40)

The most common and damaging investor penalty comes from rushing in at euphoric high prices and panic selling at the lows. Here's a real alternative.

Watch Now

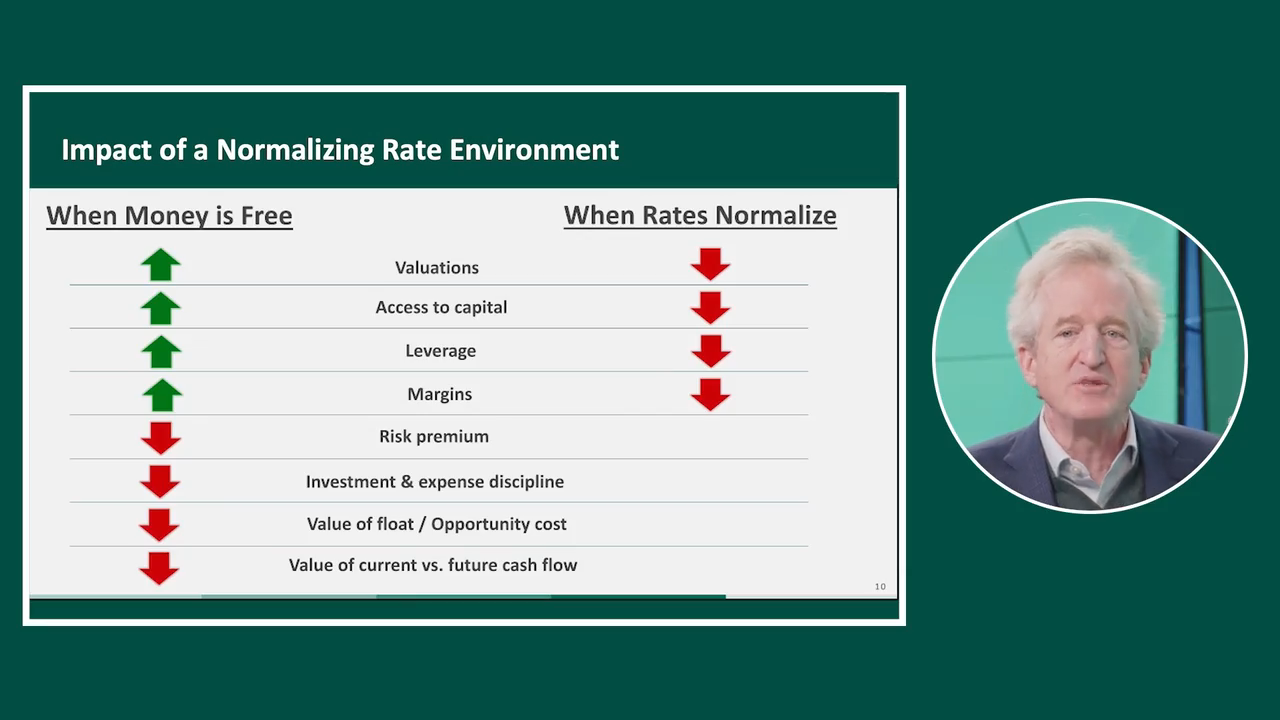

Investing in a Transitioning Market

The end of the “easy money” era is unwinding the market distortions of the past decade, reinventing the landscape for businesses and investors

Watch Now

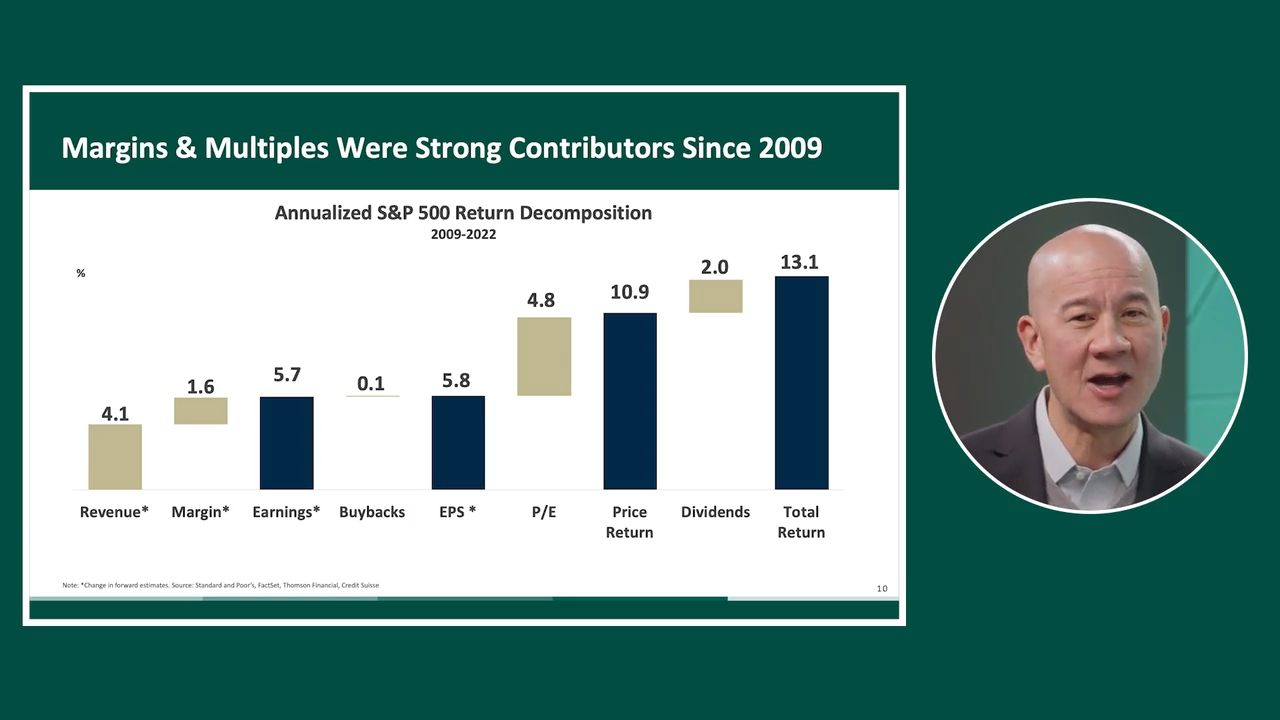

Rising Multiples Carried the Markets through the “Easy Money” Decade. What’s Next?

With normalizing rates, companies will need to earn their higher valuations. Find lower-multiple companies with sustainable and growing margins.

Watch Now

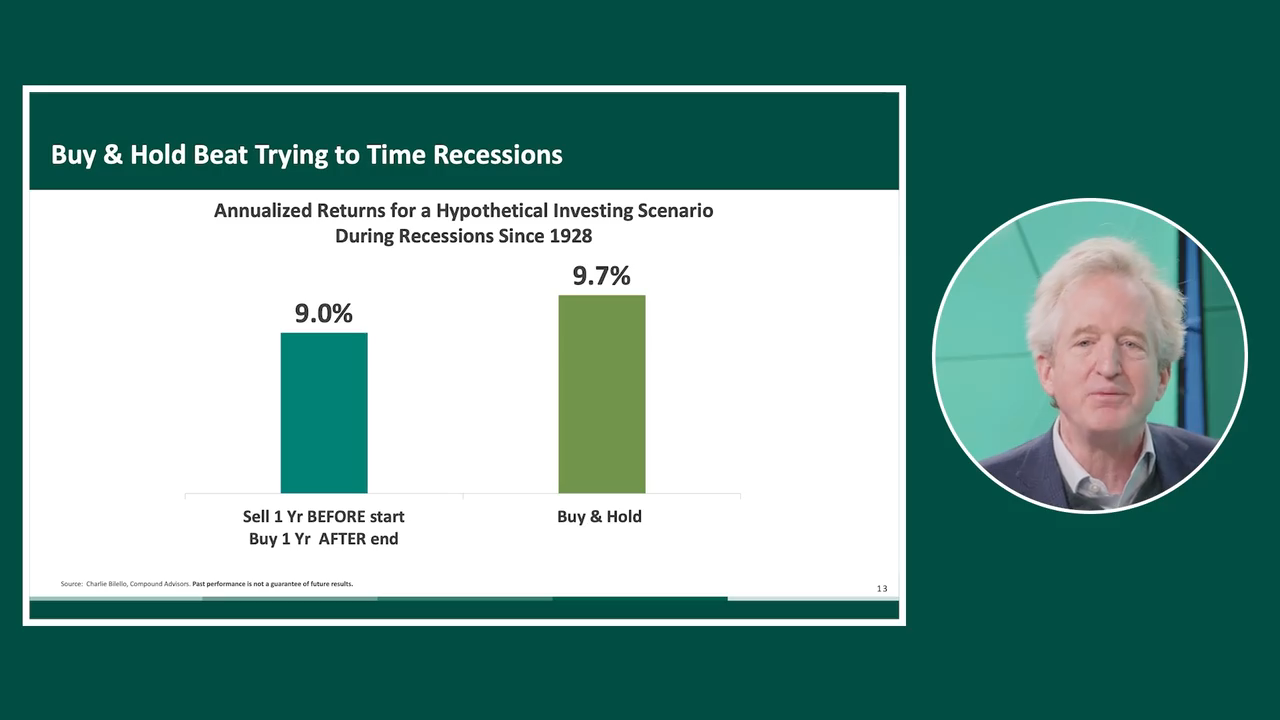

Recession Coming? Timing Investment Decisions to Predictions is a Loser’s Game

Buy and hold regularly outperforms guessing the timing of the next recession. Align with companies that can ride out the storms.

Watch Now

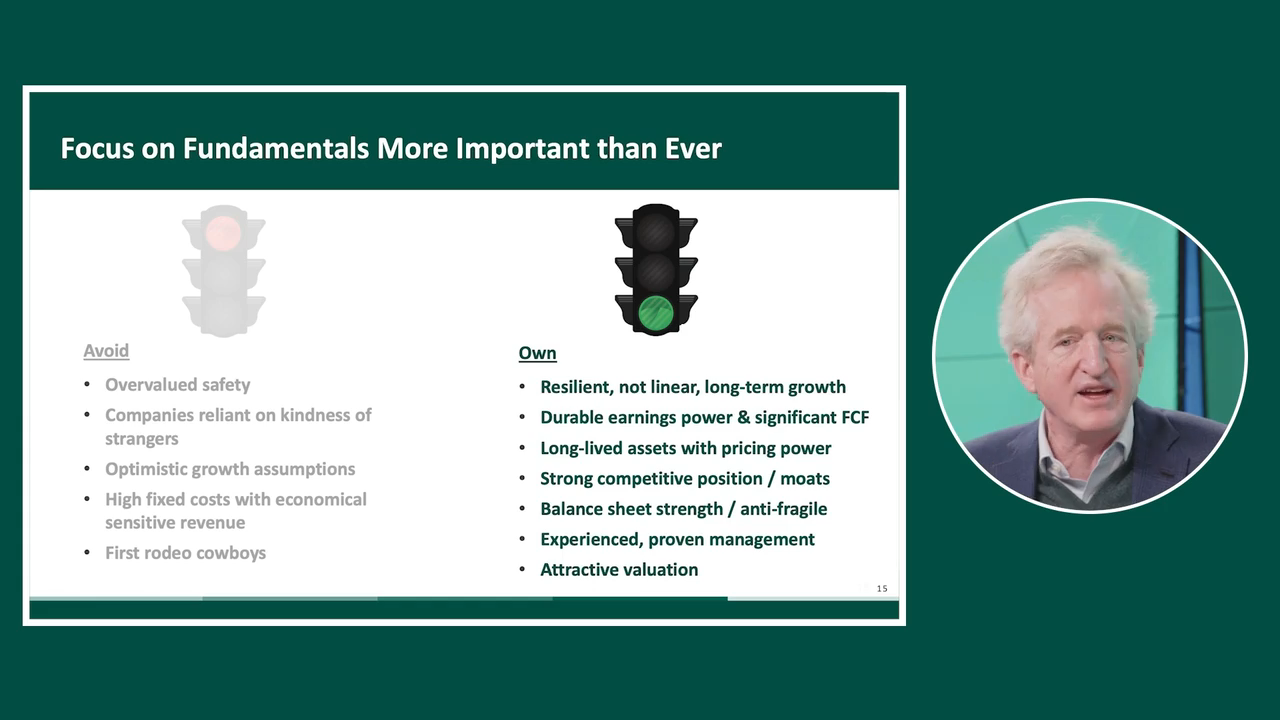

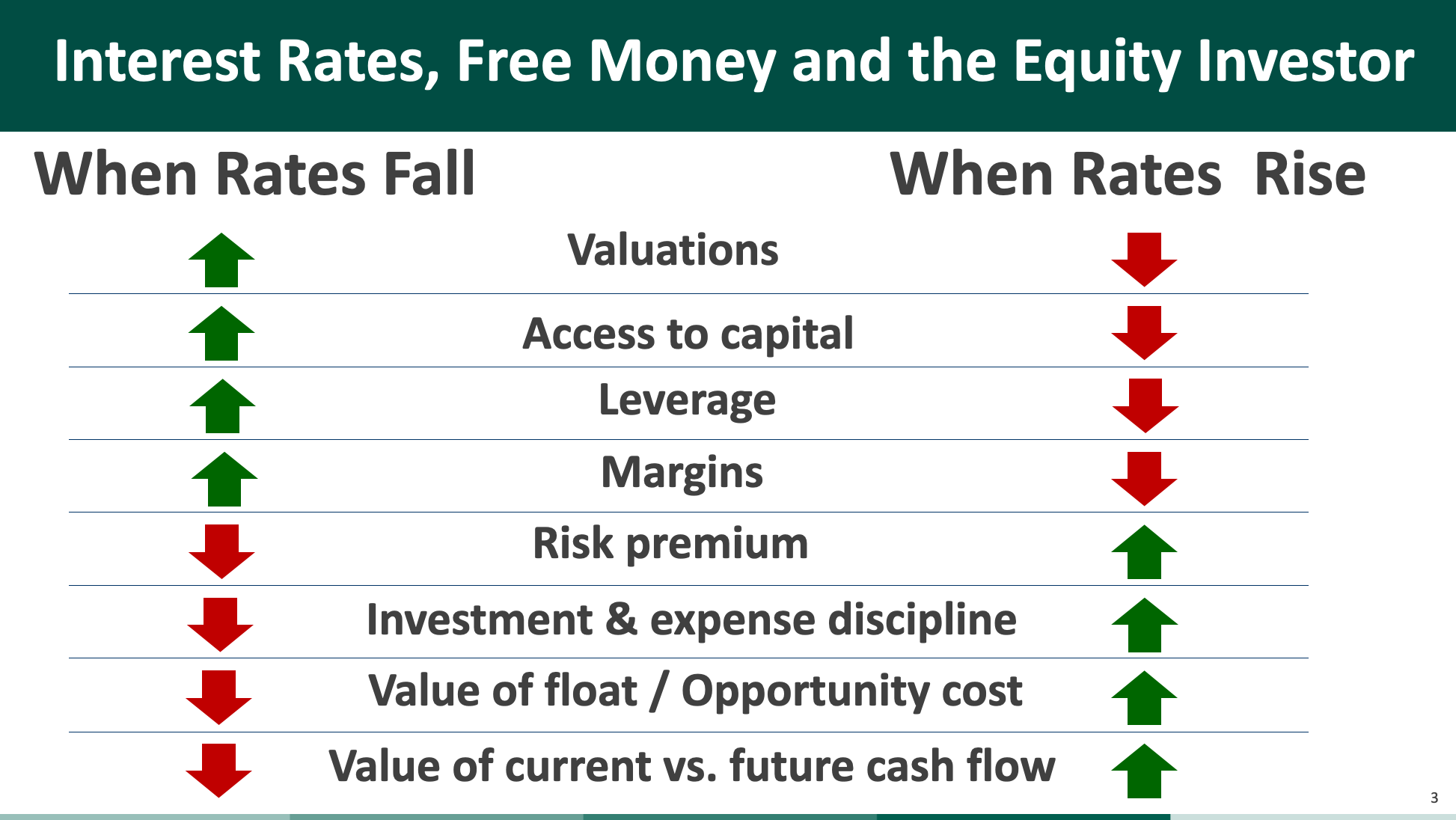

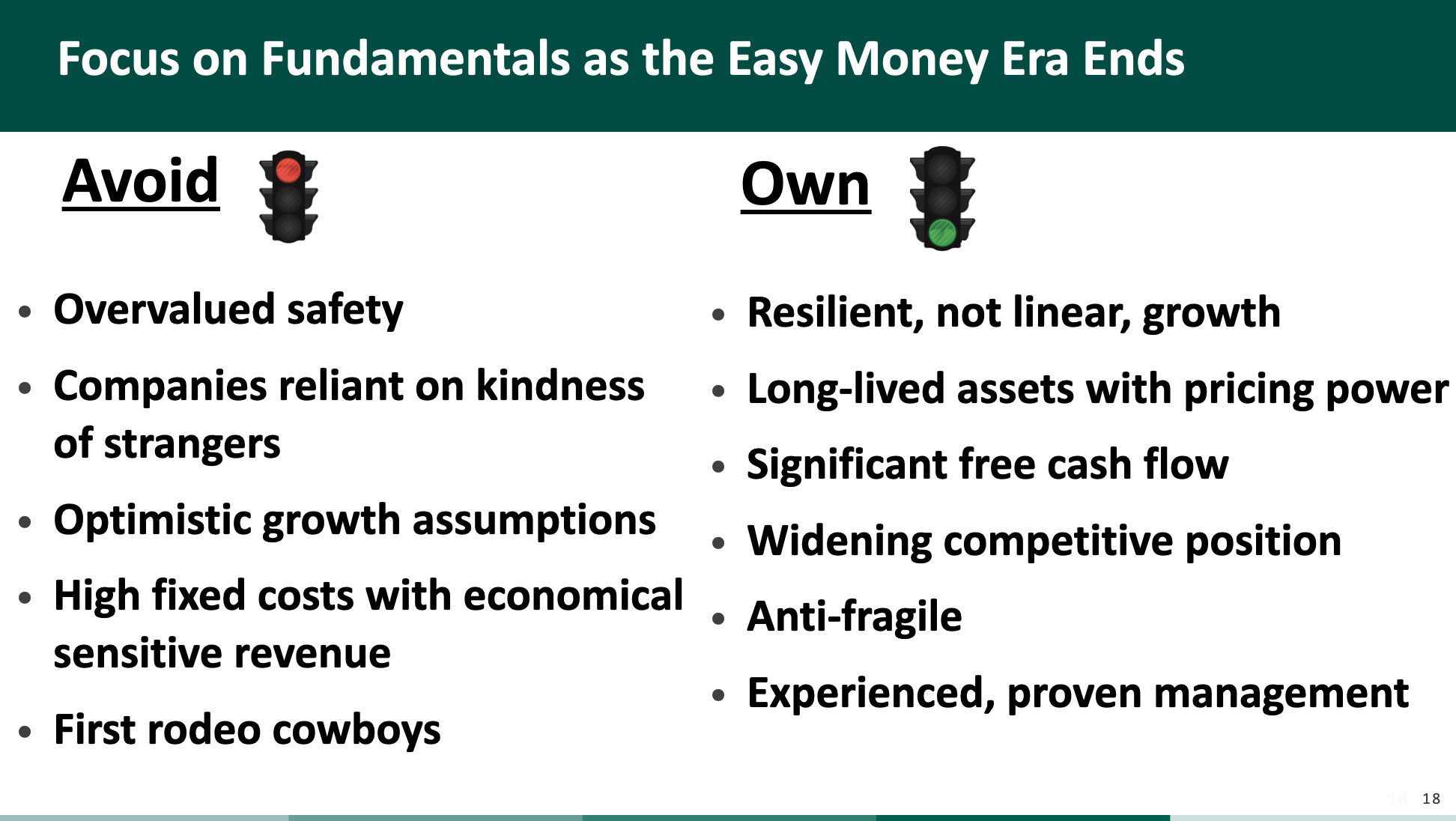

What to Own and Avoid in a Changing Environment

As rates normalize, specific companies attributes may be rewarded or penalized by the markets

Watch Now

Investment Themes We’re Focusing On Today

Why we’re focusing on select opportunities within Financials, Tech at a reasonable price, Healthcare and Industrials

Watch Now

Why All Financials are Not Created Equal

“Financials” are often mistakenly lumped together, despite their wildly differed risk and opportunity profiles. The best are being rewarded by investors, but remain undervalued

Watch Now

Tech – The Magnificent 7 and Beyond

Focus on the Tech Stalwarts with reasonable valuations, in addition to the Online Giants

Watch Now

AI Impact Across Industries and Sectors

Ways artificial intelligence will be impacting business costs and productivity – in ways not yet reflected in their valuations

Watch Now

A Closer Look at Healthcare and Industrials

Demographic tailwinds benefitting Healthcare Services, a focus on electrification and energy efficiency among Industrials

Watch Now

The Return to Rationality

The bursting of the easy money bubble marks a huge transition for the markets

Watch Now

Investor Implications of Rising Rates

How the end of the free money era is ending the distortions of the past decade and returning rationality to the marketsv

Watch Now

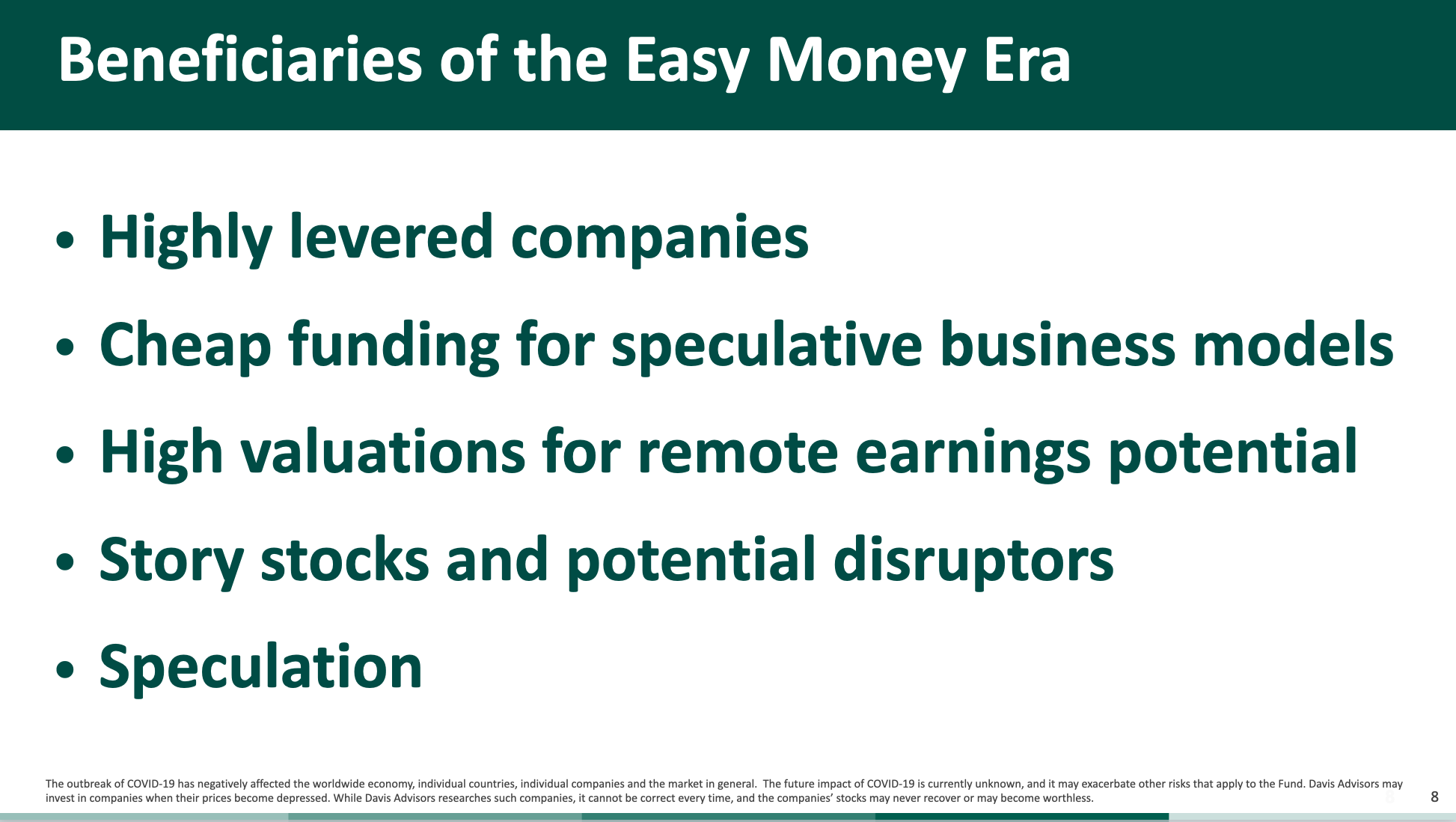

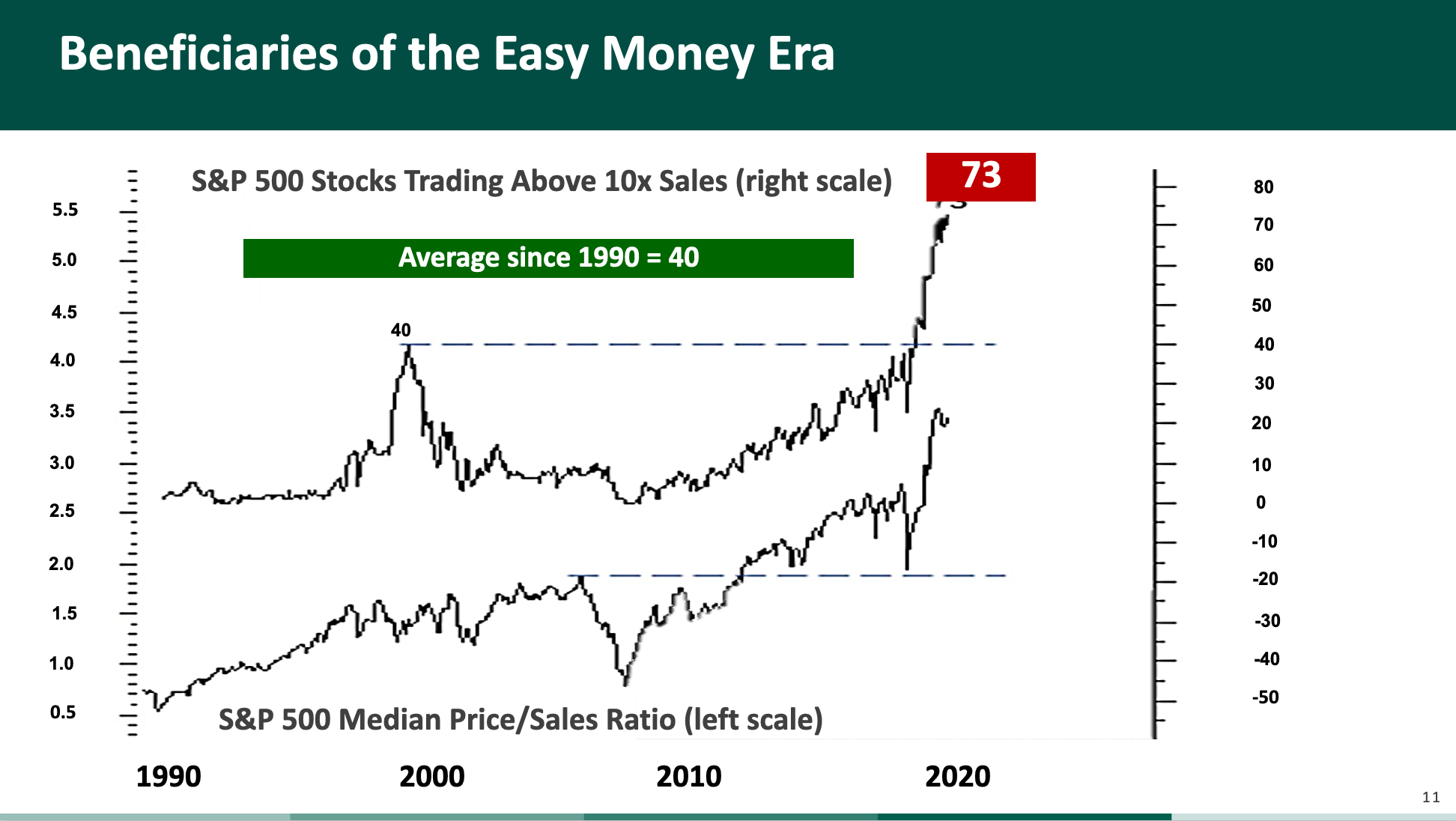

The Easy Money Era – Who Was Helped

The long period of low interest rate fueled a bubble, creating widespread market distortions and irrational valuations

Watch Now

Companies Who Rode the Easy Money Bubble

Examples of how the low interest bubble era fueled speculation and irrational valuations

Watch Now

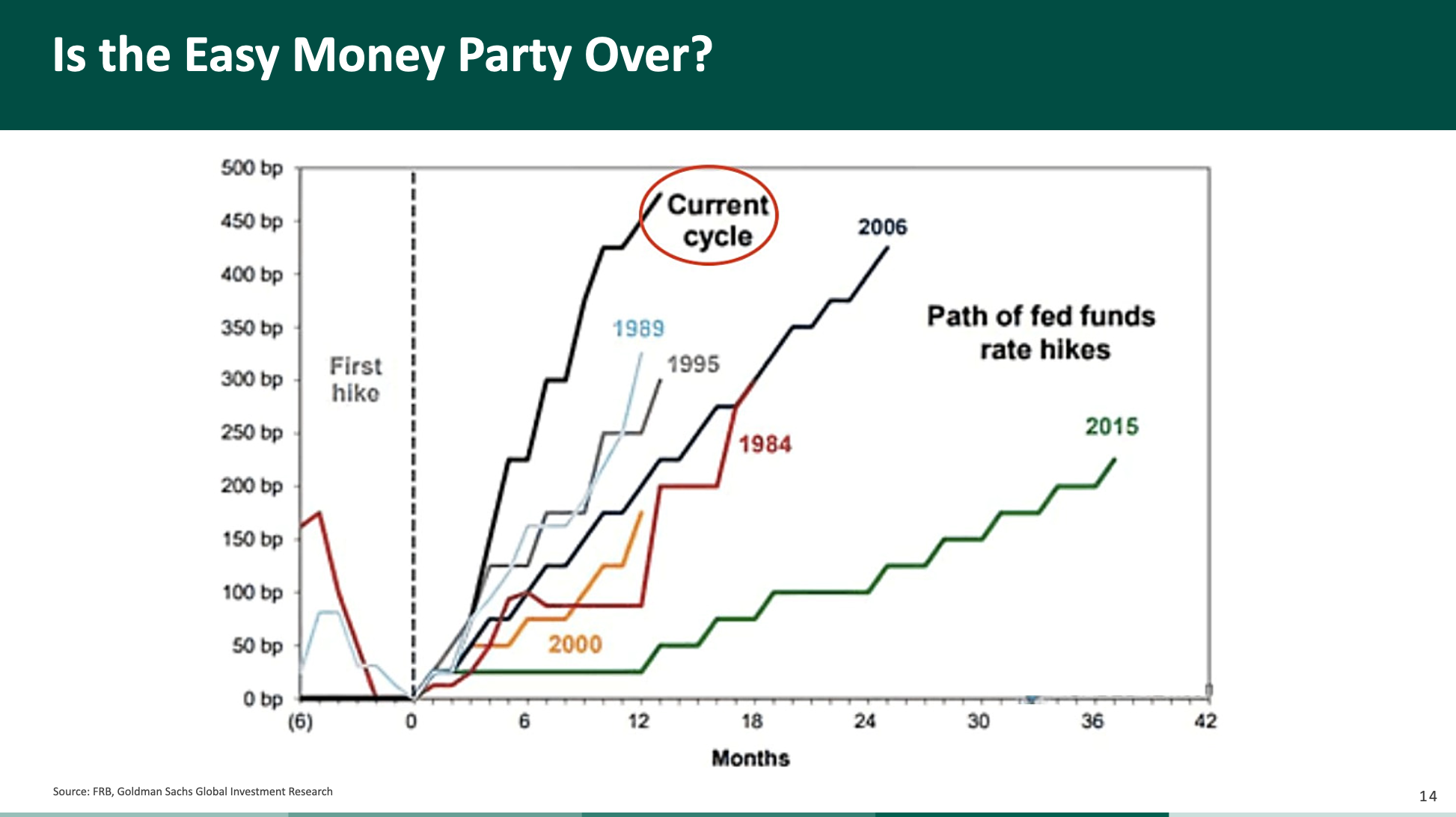

The Bursting of the Speculative Bubble

The speed of the current rate-hiking process and how it’s impacting companies who benefitted in the easy money era

Watch Now

What to Own and Avoid in Today’s Market

What types of companies should be avoided, and which stand to benefit from the end of the easy money era

Watch Now

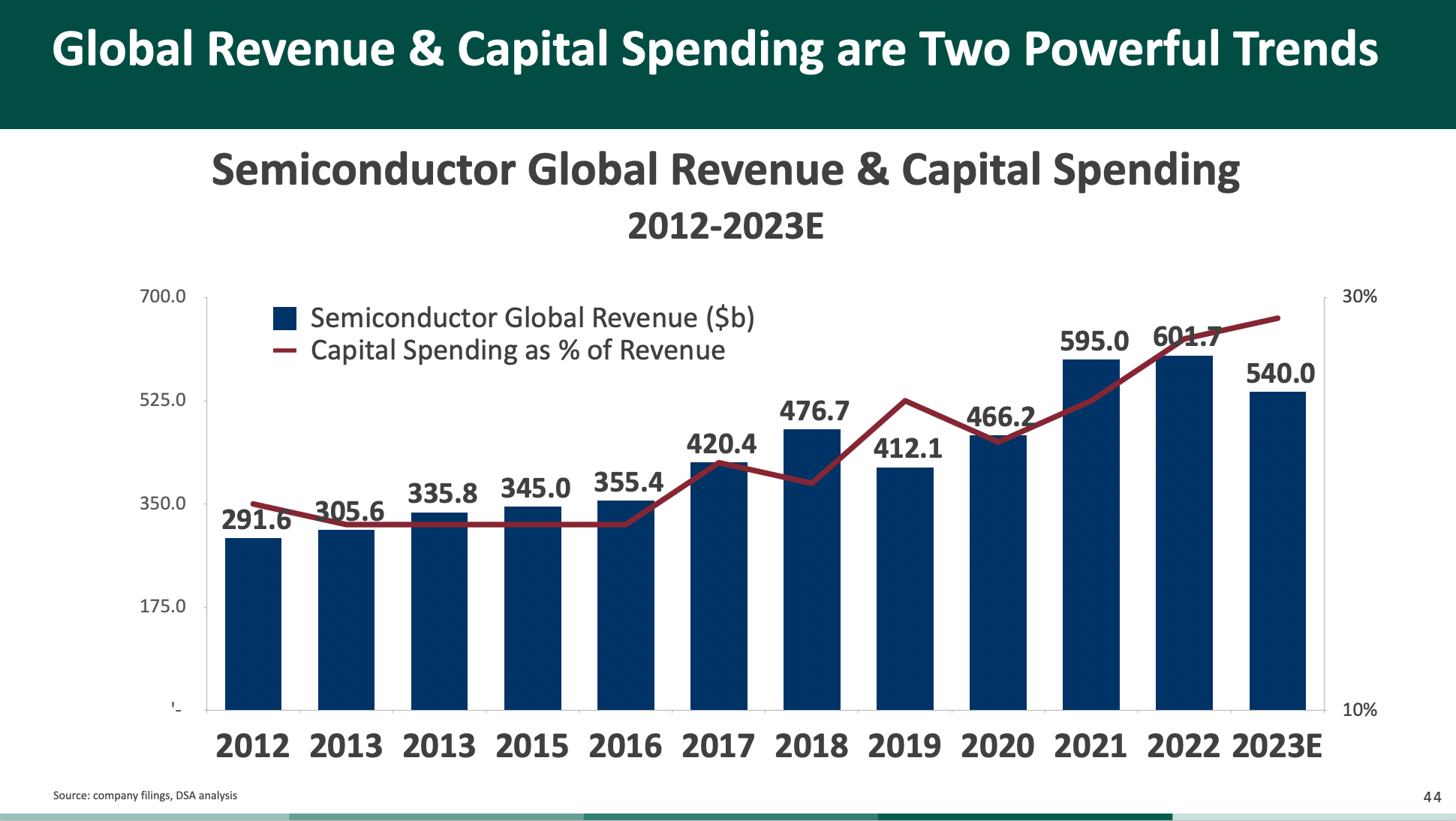

The Opportunity in Semi-Conductors

The huge, long-term tailwinds driving Semiconductor growth

Watch Now

Navigating Headwinds with Active Management

The ever-expanding margins and valuations of the past decade are unlikely to be sustained

Watch Now

Evolution of the Economy is Creating Unique Opportunities

Electrification is driving copper demand, and the “decarbonizing” of energy is driving biofuels

Watch Now

Finding Value Stocks in a Market Dominated by the Magnificent Seven

Investors have rushed to a narrow universe of companies, driving valuations higher and placing the stocks in danger if growth disappoints

Watch Now

Why Select Banks are Undervalued Today

Why we believe select banks are attractive, given their durability, long-term growth, competitive advantages, growing market share and attractive valuations.

Watch Now

How Investors Should Prepare for the End of the “Easy Money” Era

As rates normalize, certain business models are going to be severely challenged. What kind of companies do you want to own?

Watch Now

Volatility is the Price of Admission for Long-Term Returns

To benefit from the wealth-building potential of equities, investors need to understand that pullbacks and drama will be an inevitable part of the journey.

Watch Now

Equities Role During Periods of Inflation

How inflation quietly eats away at the purchasing power of consumers and how Equities – while volatile in the short term – can help investors build long-term wealth faster than inflation can degrade it

Watch Now

“Fragile Value” & “Speculative Growth” Areas to Avoid

Identifying vulnerable companies in both the Value and Growth camps – each dangerous in their own ways

Watch Now

Recession Potential and Impact on Portfolio Positioning

Predicting is futile. Buy businesses that have proven resilient through the inevitable storms. Investors are now being reminded of the critical importance of business durability.

Watch Now

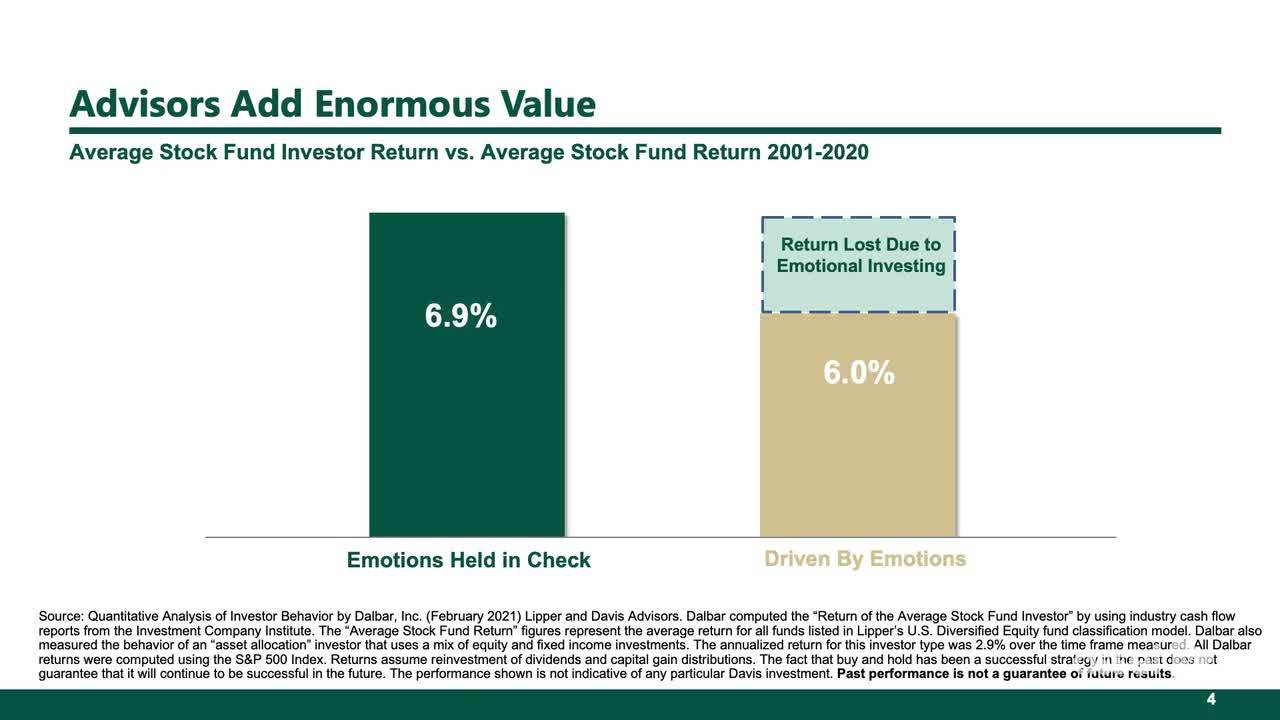

The Incredible Value Advisors Can Add During Volatile Markets

How the guidance of a financial advisor can help investors successfully build wealth as they navigate inevitable market volatility.

Watch Now

The Types of Businesses That Can Build Generational Wealth

Identifying great businesses with above average growth, resiliency and competitive advantages, but at discounts to the index.

Watch Now

Why Successful Investors Keep Emotions in Check

How emotion can impact the ability of investors to successfully compound wealth and the importance of partnering with a financial advisor.

Watch Now

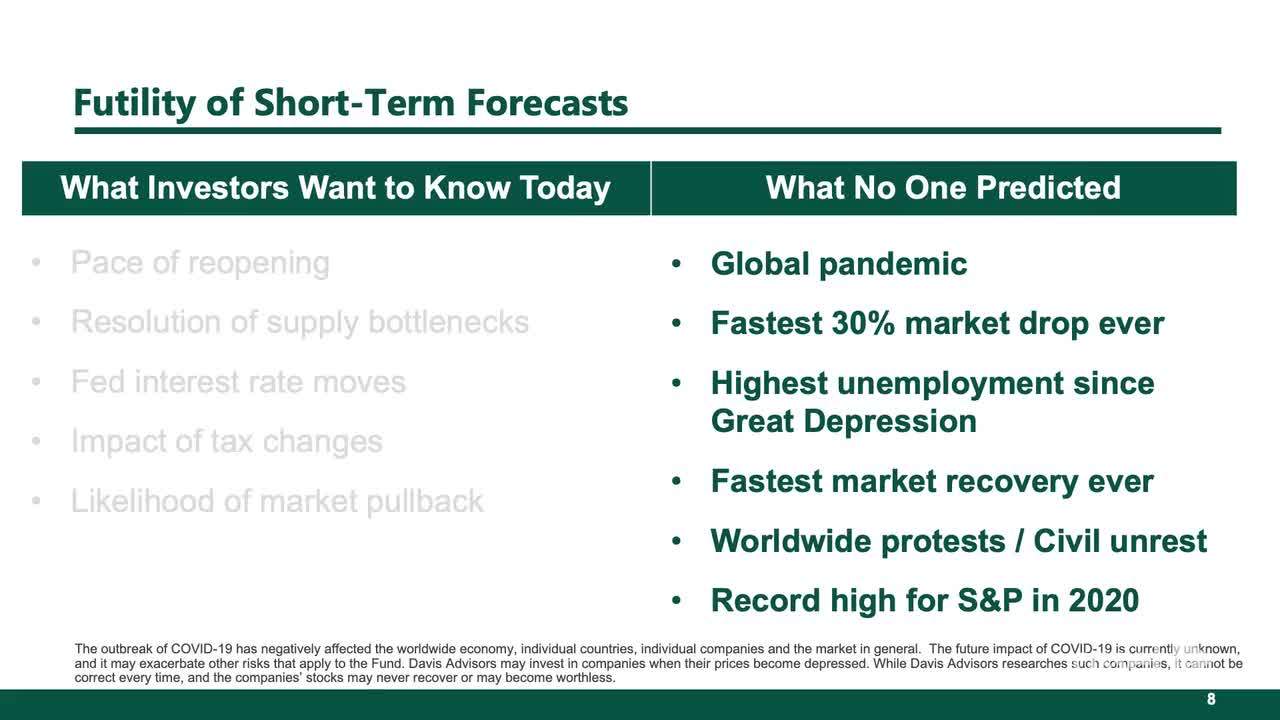

Why Investors Should Disregard Short-Term Forecasts

Market forecasters have a terrible record of predicting the future. Investors influenced by them may be sabotaging their returns.

Watch Now

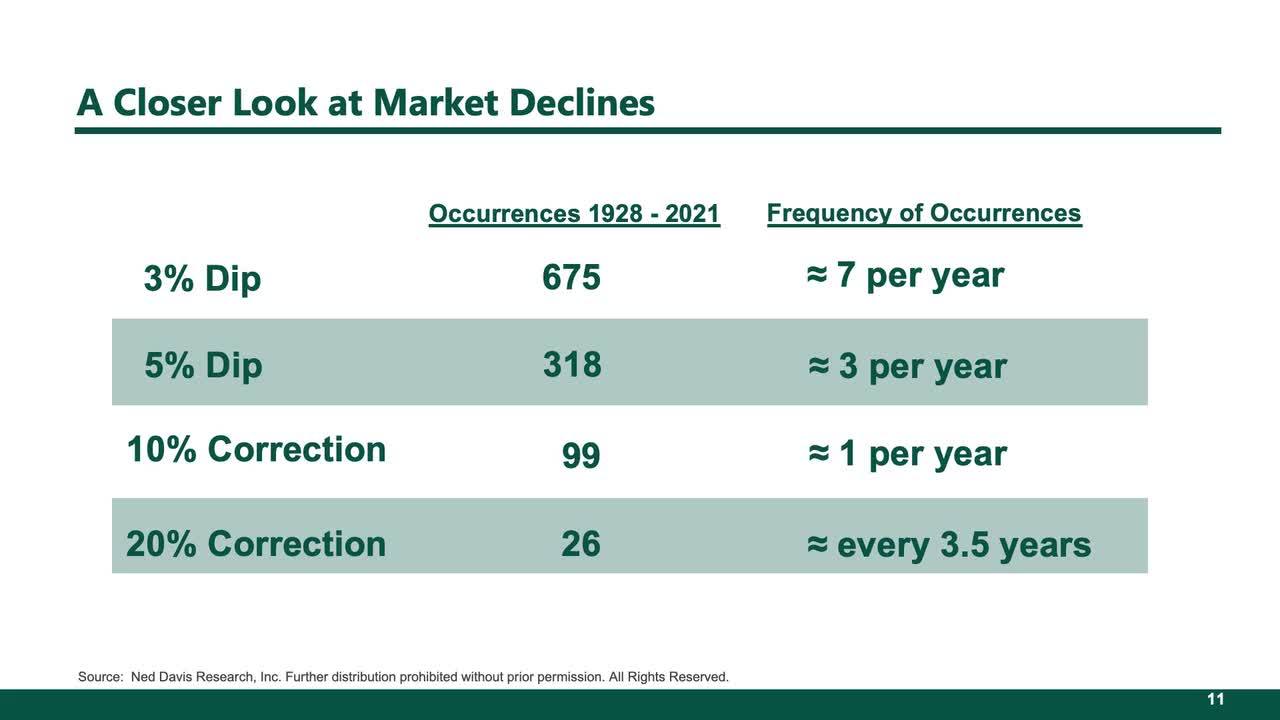

Recognize that Market Declines are Inevitable

10% market corrections happen once a year on average. Don’t allow these inevitable pullbacks to sway you from your investment plan.

Watch Now

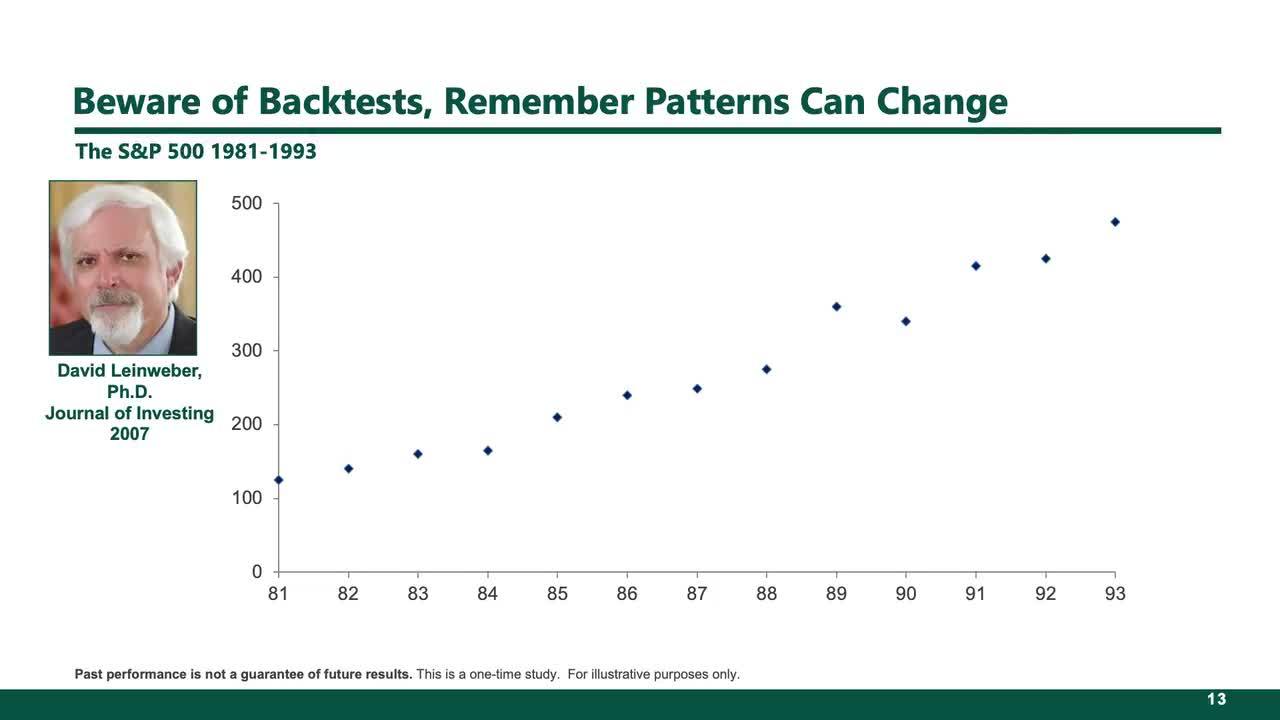

Correlation Does Not Equal Causation

The danger of investment products built on back testing. Markets continuously evolve and factors that seemed to have worked in the past may not work going forward.

Watch Now

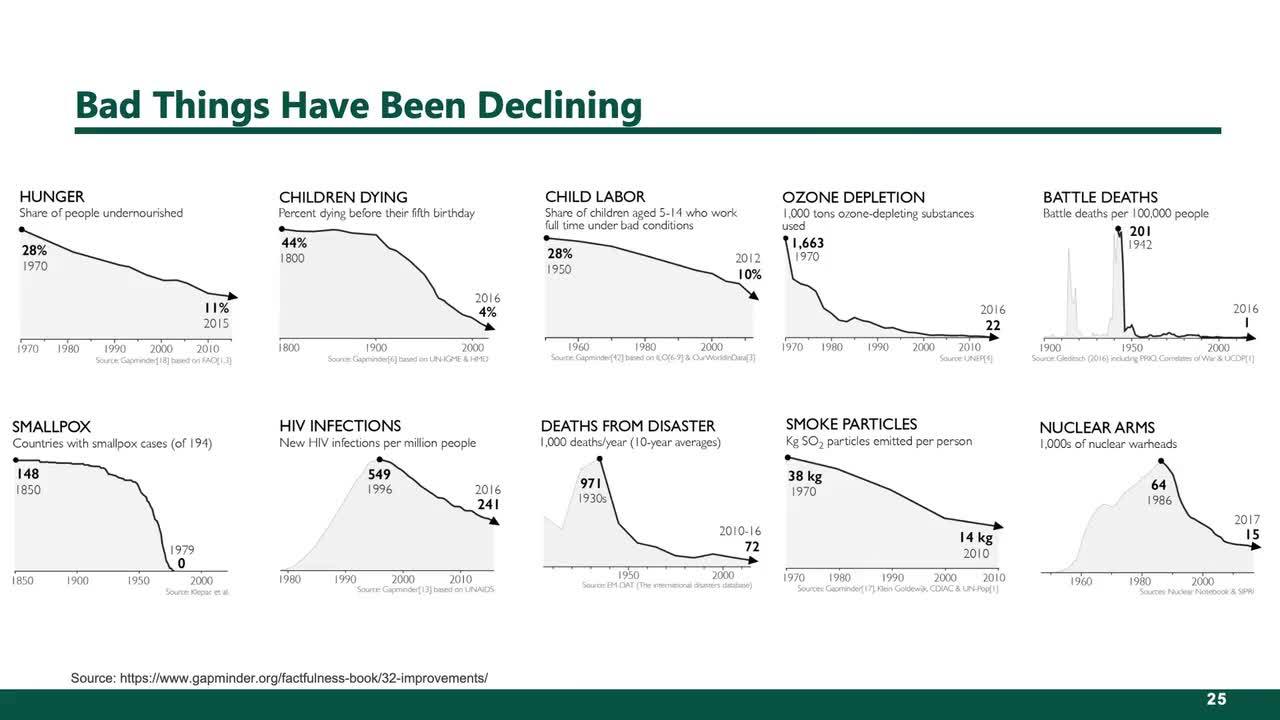

You Always Sound Smarter when You’re Bearish

The vast majority of factors across society and around the world have improved massively for decades. Betting against long term progress is a loser’s game.

Watch Now

How Inflation Impacts Portfolio Positioning

The types of companies that may continue to thrive if inflation increases.

Watch Now

Tuning out the Tweets

The most important lessons on successfully compounding wealth from our 50 years in the equity markets

Watch Now

Why International

Why investors looking to maximize investment opportunity need to consider the many growing, high quality companies outside the U.S.

Watch Now

Active Management Can Add Value

The qualities to look for in an active manager that have fostered outperformance versus the passive indices

Watch Now

Davis Advisors – Unique Attributes

Why our commitment to a single investment philosophy, uncommon co-investment, true active management and experience have generated attractive returns versus the benchmarks over nearly half a century

Watch Now

Davis Advisors Launches Davis Select International ETF (DINT)

Listen to Portfolio Manager Danton Goei discuss the launch of DINT - Davis Select International ETF

Watch Now

Davis & Goei: Actively Managed ETF Pioneers

Consuelo Mack interviews PMs Chris Davis and Danton Goei on the key advantages of active management within an equity ETF

Watch Now

Davis Advisors: Proven Active Management

Chris Davis on his firm’s time-tested, benchmark-agnostic investment approach, and two fundamental questions that lie at the heart of their research process.

Watch Now

The Davis Select Worldwide ETF (DWLD)

Danton Goei, Portfolio Manager of DWLD, on his high-conviction, benchmark agnostic investment approach, where the portfolio is invested geographically and two representative holdings.

Watch Now

Key Considerations When Placing ETF Trades

Dodd Kittsley, Davis Director of ETFs, on four tips for investing in ETFs, including using limit orders, avoiding trades at the market open and close and more.

Watch Now

The $1000 Hot Dog

Chris Davis tells Barron’s about the powerful lesson his grandfather taught him about thrift, financial independence and the miracle of compounding.

Watch Now

The Importance of Healthy Investor Behavior

Chris Davis on common pitfalls that often sabotage an investor’s return and how advisors can help.

Watch Now

Why should equity investors be optimistic about the next decade?

The folly of short term forecasts, and putting current stock market valuations into perspective

Watch Now

Why look around the world for investment opportunities?

Investors looking to build wealth should seek the best businesses, wherever they happen to be headquartered

Watch Now

Wisdom from Buffett, Munger & Graham

The profound influence these investment icons have had on our firm and philosophy.

Watch Now

Barron's Interview: Risk May Not Be What You Think It Is

PM Chris Davis offers perspective that can help every investor.

Watch Now

Where is the Market Headed from Here?

No one can consistently predict the markets over the short term, yet there are ways to invest with confidence to reach your long-term goals.

Watch Now

Investment Lessons from My Grandfather & Father

“You make most of your money in a bear market, you just don't realize it at the time”, and other key insights.

Watch Now