Focus on the Tech Stalwarts with reasonable valuations, in addition to the Online Giants

Transcript

Danton Goei:

We have a good diversity of technology names there, but we've really focused more on the stalwarts versus the darlings. Now, you'll see in our holdings we do have a number of the Magnificent Seven.

We think they're the ones where the competitive advantage is very clear, where the business is very durable and where the valuation is still very attractive, but there are also a number of other names in technology that we have that are not part of that top seven. It's between social media and semiconductors, AI is a big driver. The Meta, Amazon, Alphabet, they're all big part of that Magnificent Seven, but Applied Materials, Texas Instruments, probably more of these stalwarts that are also big beneficiaries of the same growth drivers of semiconductor demand, digitization of the economy, artificial intelligence, they're all big, a driver, taking advantage of that as well.

More Videos

Electrification, Teck Resources & the Supply / Demand Mismatch in Copper (3:25)

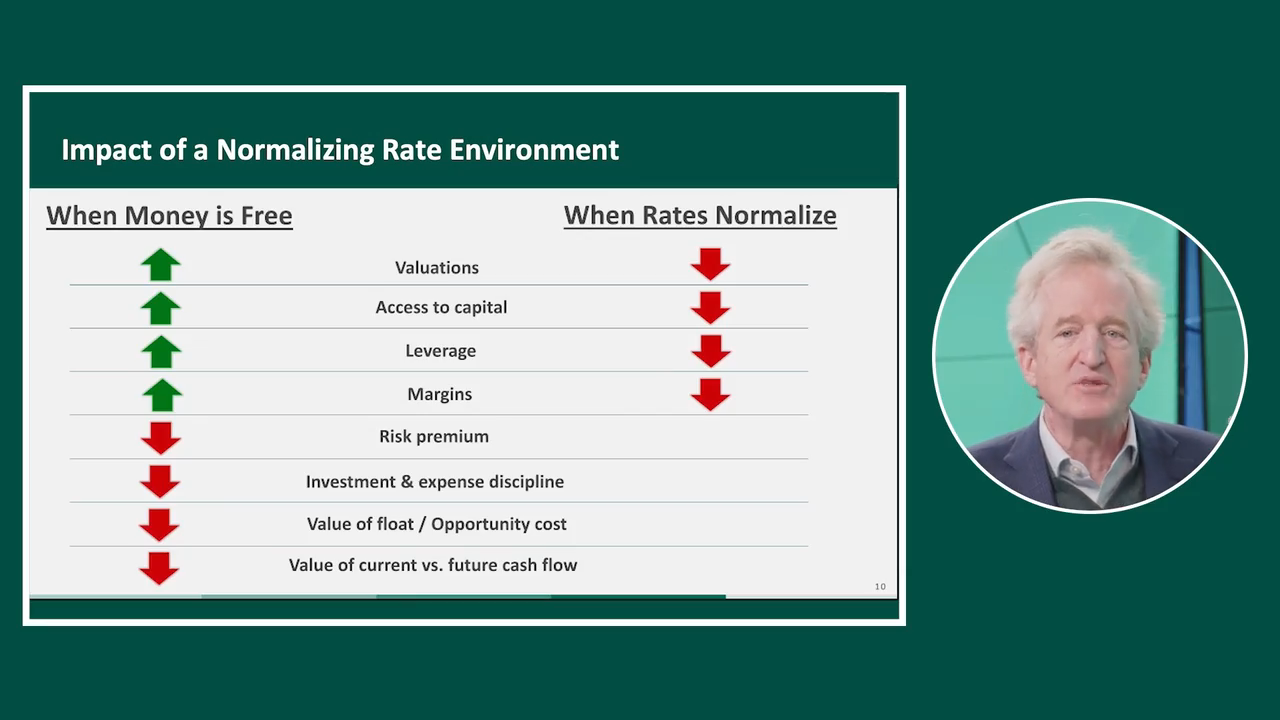

Investing in a Transitioning Market