Dodd Kittsley, Davis Director of ETFs, on four tips for investing in ETFs, including using limit orders, avoiding trades at the market open and close and more.

More Videos

Rigorous Research & Selectivity are Critical in Today’s Market (2:14)

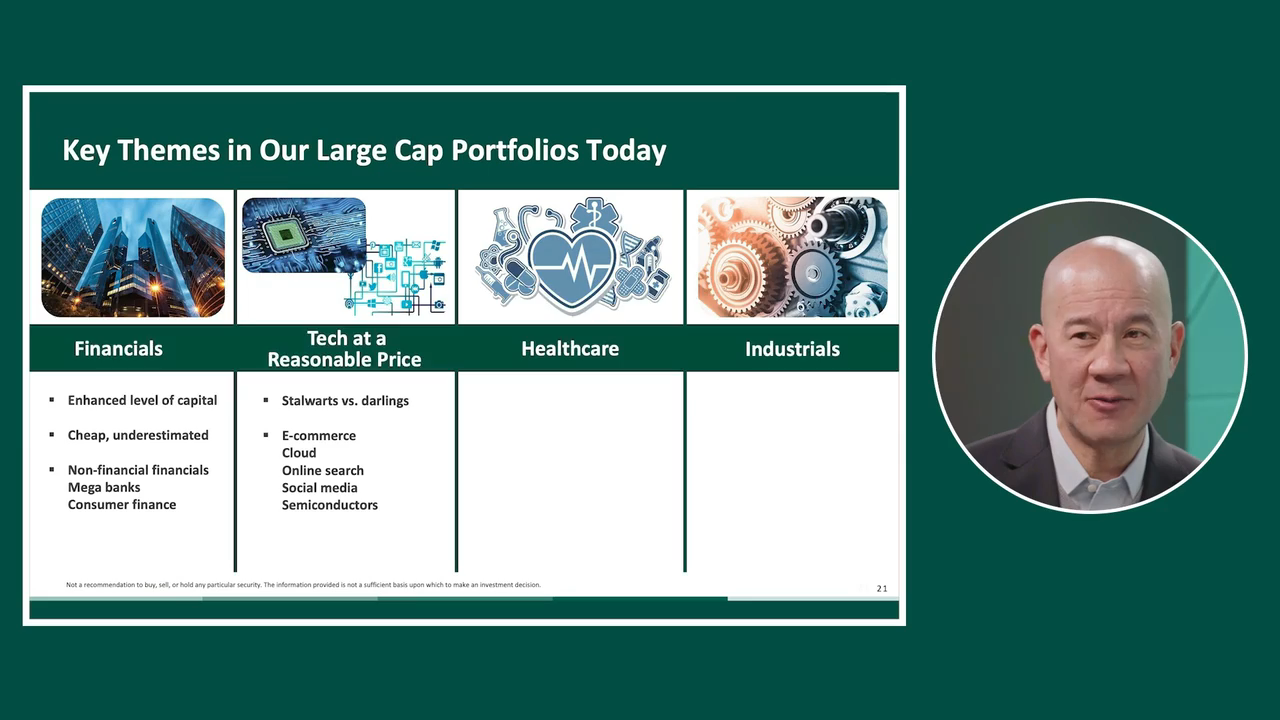

Tech – The Magnificent 7 and Beyond