Why we see tailwinds and opportunities across Financials, Tech, Healthcare and Industrials

Transcript

Chris Davis:

Although Danton and I build our portfolios, one company at a time from the bottom up, what we do find over the long term is as we look out at the economy, certain themes tend to emerge. Their themes where we're looking to, uh, get, uh, industries that have tailwinds, uh, that enable them to navigate a time of uncertainty.

So we can spend time talking about the industries that we aren't interested in or that we see as being prone to disrupt option, or hype, or overvaluation, or classic sort of value traps, but instead we're going to invert it and say, really where do we see the opportunities in this environment? And there are four themes that sort of coalesce around the vast majority of the portfolio. The first is financial services broadly defined.

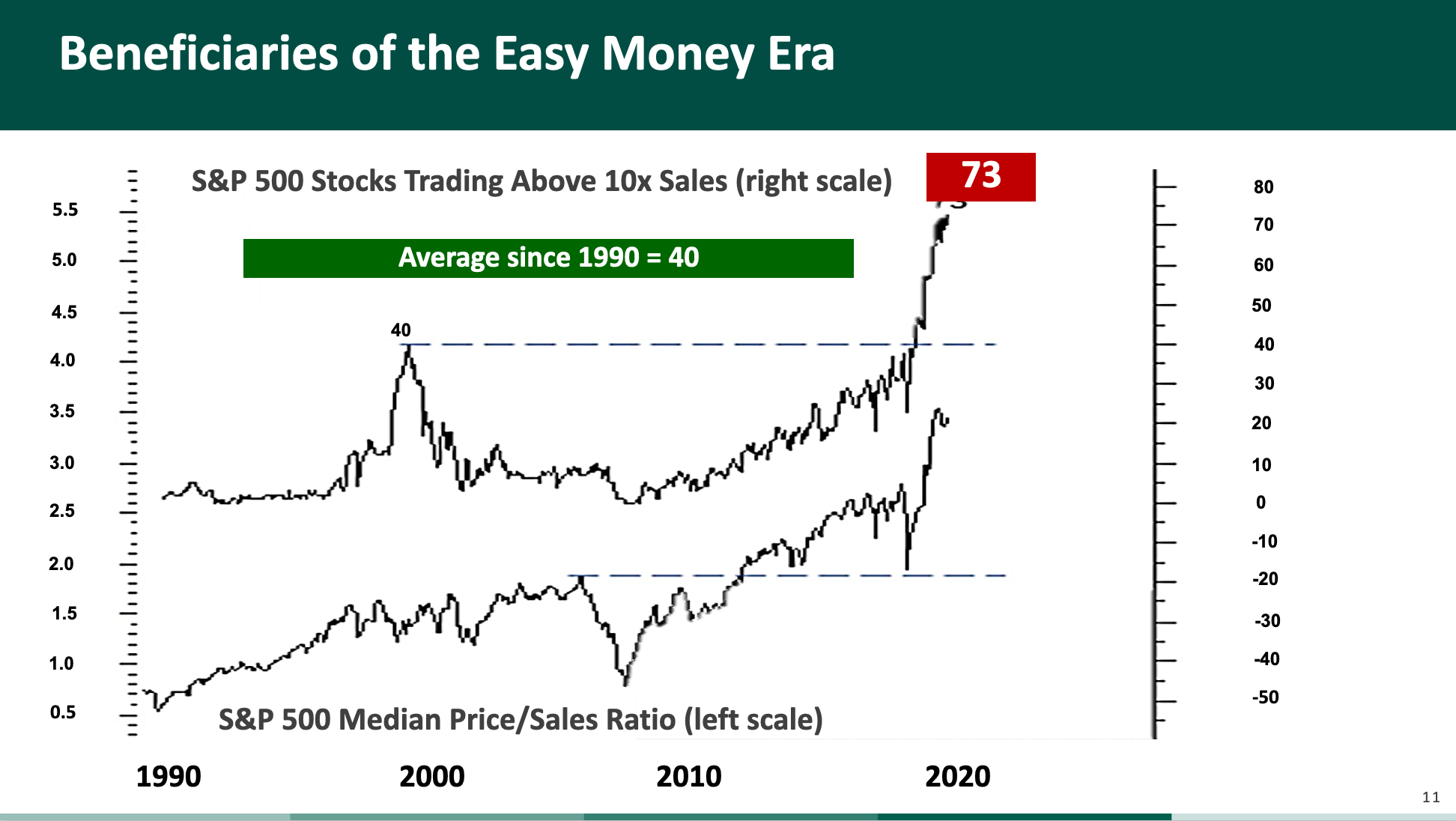

The second is technology or the beneficiaries of this continue advance in innovation and the sort of technologification of the U.S. economy and of the global economy. Who are the beneficiaries?

The third is healthcare. Of course, people go back to demographics over and over. But what we know is that healthcare spending is sort of a relentless growth force in the economy. And being participating in that growing pool is a good place for investors to be in the long term.

And then the fourth is a bit of a catch-all. But we think of it as industrials. And what we mean by that is the old-fashioned business of making stuff, making things that are needed in an important part of what fuel the economy can easily be forgotten when everybody is focused on software and high-tech,and internet spaces and services. Don't forget that somebody is making that stuff, and often those companies have wide and durable modes, and that's the fourth theme that we look at.

More Videos

Stewardship, Patience and Going Against the Crowd (3:59)

Why look around the world for investment opportunities?