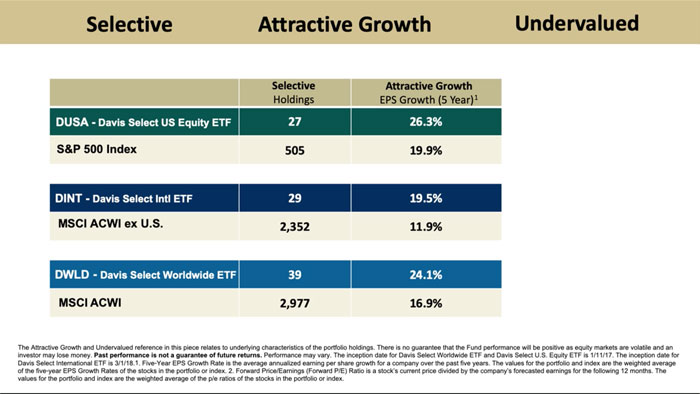

Investors looking to build wealth should seek the best businesses, wherever they happen to be headquartered

More Videos

Tuning out the Tweets

The Types of Businesses That Can Build Generational Wealth