Market forecasters have a terrible record of predicting the future. Investors influenced by them may be sabotaging their returns.

More Videos

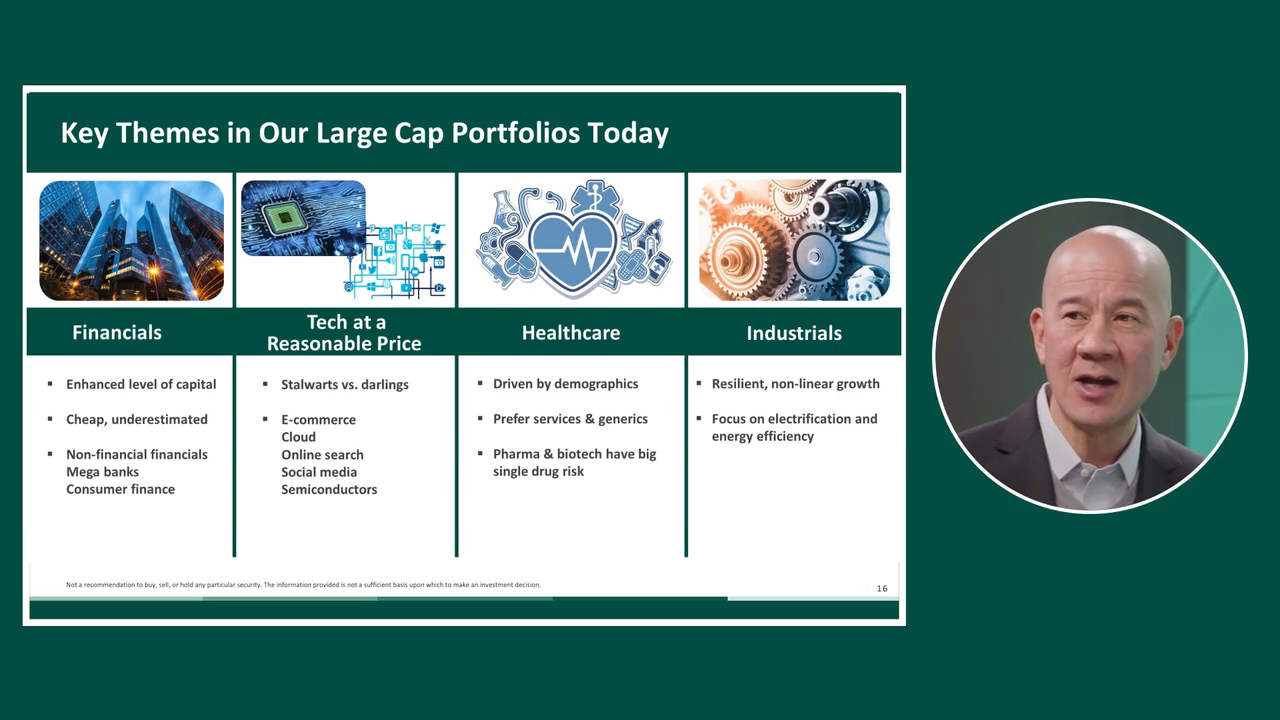

Investment Themes We’re Focusing On Today

Why we’re focusing on select opportunities within Financials, Tech at a reasonable price, Healthcare and Industrials

Watch Now

Why look around the world for investment opportunities?

Investors looking to build wealth should seek the best businesses, wherever they happen to be headquartered

Watch Now

Why International

Why investors looking to maximize investment opportunity need to consider the many growing, high quality companies outside the U.S.

Watch Now