What types of companies should be avoided, and which stand to benefit from the end of the easy money era

More Videos

What Gets You Excited About the Next Decade? (2:49)

Beyond the growth expected via breakthrough technologies, the low prices produced by uncertainty should excite every rational investor

Watch Now

Investing through Volatility

PM Chris Davis on developing a mindset that allows you to tune out the daily drama and successfully build wealth.

Watch Now

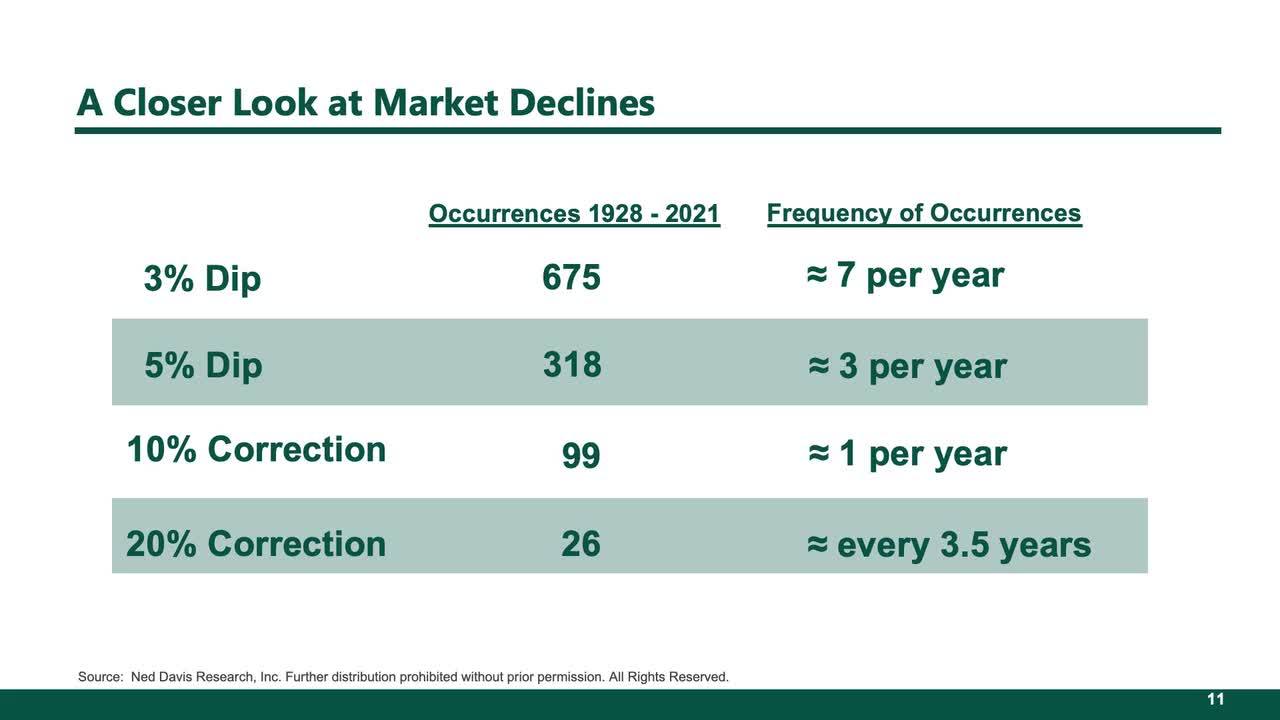

Recognize that Market Declines are Inevitable

10% market corrections happen once a year on average. Don’t allow these inevitable pullbacks to sway you from your investment plan.

Watch Now