Why our commitment to a single investment philosophy, uncommon co-investment, true active management and experience have generated attractive returns versus the benchmarks over nearly half a century

More Videos

Four Active ETFs from Davis (2:55)

Overview of our 4 ETF strategies, providing access to the Davis investment discipline with the conveniences of the ETF structure

Watch Now

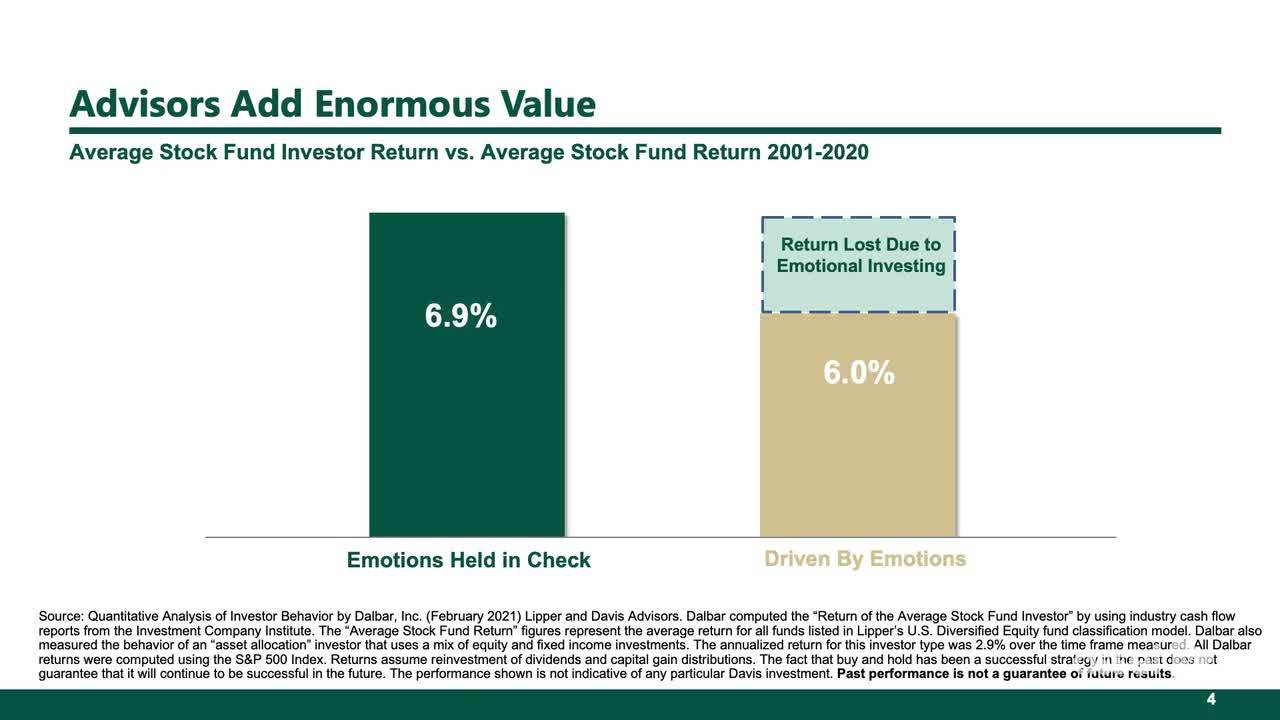

Why Successful Investors Keep Emotions in Check

How emotion can impact the ability of investors to successfully compound wealth and the importance of partnering with a financial advisor.

Watch Now

Financials – Underappreciated and Undervalued

Why are Financials attractive now? Financials are the cheapest sector in the market, yet have the strongest balance sheets in their history, growing market dominance, record net income and an improving regulatory environment.

Watch Now