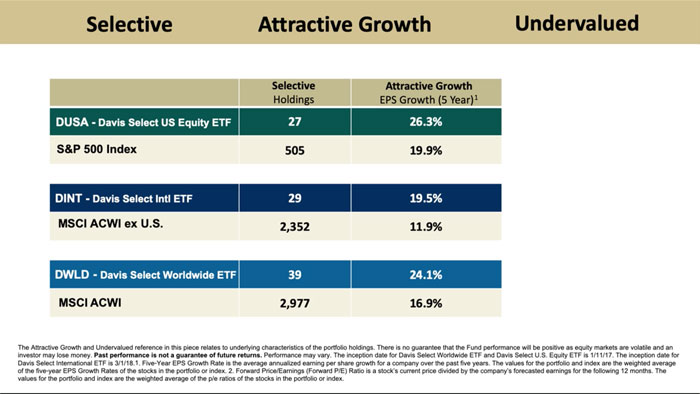

The basic question our PMs ask: “What kind of businesses do you want to own, and how much do you want to pay?”

Transcript

Dodd Kittsley:

So our investment discipline is really kind of broken down into two basic parts. First is what kind of businesses do we want to own?

We think it's as important to really look at what you don't own, uh, as much as what you do own.

And, we're looking for businesses that are first and foremost durable, uh, meaning that they have strong balance sheets. They have the ability to stay in difficult times.

And we all know difficult times are going to come now and then. And that's one of the big concerns out there today is people worried about an impending recession.

We don't know when it's going to happen. Well, the businesses that we're looking at, we have confidence, they're going to not only be able to withstand that, but also grow and benefit through that whole market cycle.

We're also looking for companies with strong competitive advantages that are sustainable, whether that's brand, whether that's the scale of a business, This is such as in some financial services segments.

And then we want able management companies, people that are able to allocate capital on behalf of shareholders in a very prudent way, which can make all the differences in a business being successful or a business being marginalized.

The second step on a process is valuation. We want to make sure that we're not overpaying for any business. As much as we might love a business, we want get it where we're going to have an expected long term return based on our trajectory of where we think earnings are going to go.

More Videos

Tuning out the Tweets

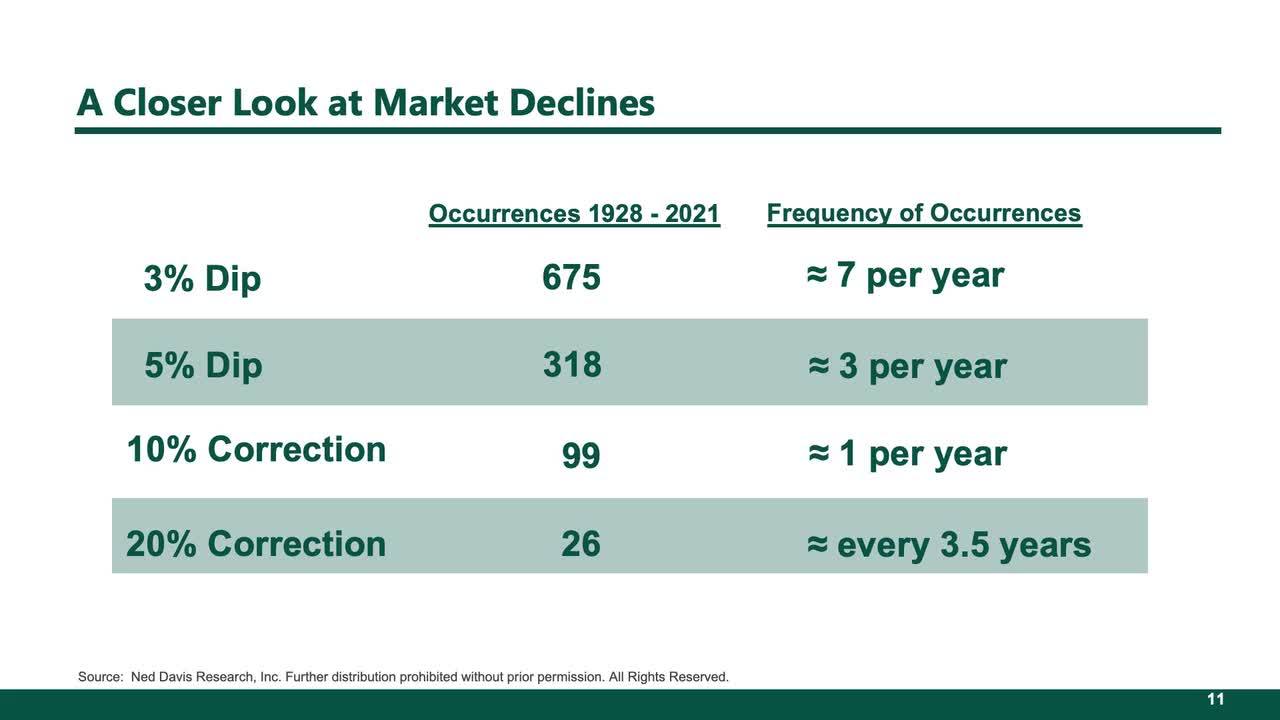

Recognize that Market Declines are Inevitable