The vast majority of factors across society and around the world have improved massively for decades. Betting against long term progress is a loser’s game.

More Videos

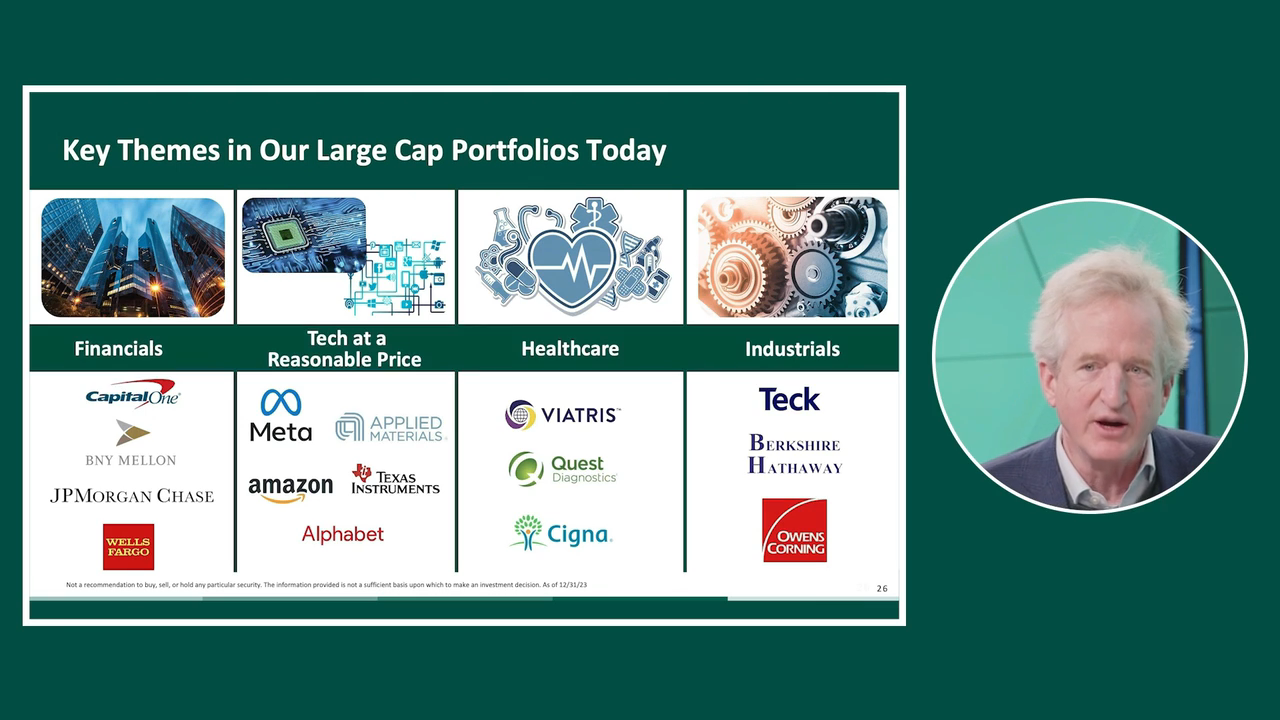

A Closer Look at Healthcare and Industrials

Demographic tailwinds benefitting Healthcare Services, a focus on electrification and energy efficiency among Industrials

Watch Now

Barron's Interview: Risk May Not Be What You Think It Is

PM Chris Davis offers perspective that can help every investor.

Watch Now

Investment Lessons from My Grandfather & Father

“You make most of your money in a bear market, you just don't realize it at the time”, and other key insights.

Watch Now