Why are Financials attractive now? Financials are the cheapest sector in the market, yet have the strongest balance sheets in their history, growing market dominance, record net income and an improving regulatory environment.

More Videos

AI Impact Across Industries and Sectors

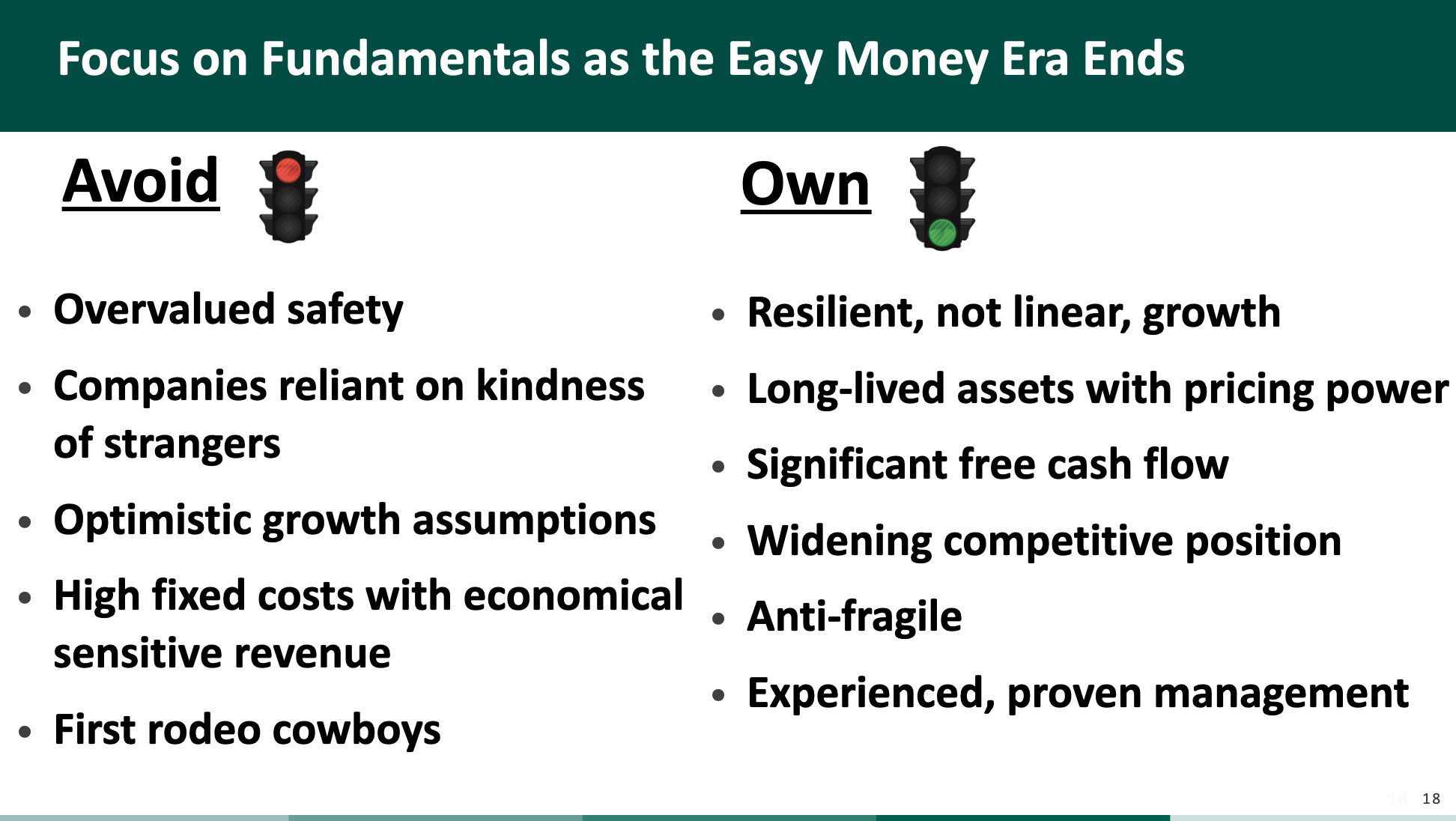

The Return to Rationality