No one can consistently predict the markets over the short term, yet there are ways to invest with confidence to reach your long-term goals.

Transcript

Where is the Market Headed from Here?

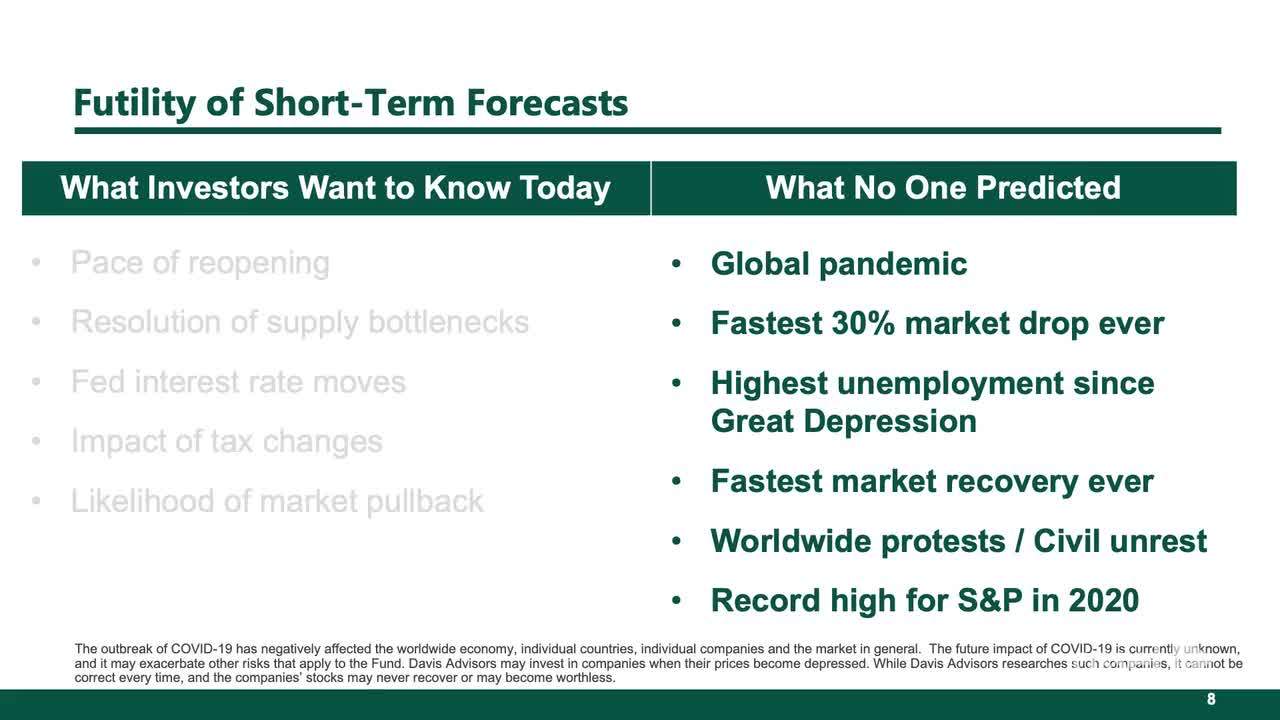

Maybe the most frequent question we get is our outlook for stock prices over the next six months, over the next year. Will prices be higher or lower? Will there be a correction or will the momentum continue? We get a similar question all the time about interest rates. Is the Fed done lowering rates? Will rates be higher in six months?

And we recognize that these are important questions and they're questions that will impact the market, but the truth is the answers are unknowable. And the data is overwhelming that such short-term predictions have no value.

For example, every six months The Wall Street Journal prints the forecast for interest rates based on the opinions and views of some of the top strategists on Wall Street. Now we keep track of these forecasts and we score them as correct if they get the direction correct. In other words will rates be higher in six months, lower in six months, or the same. And what we found over decades is that the forecast is wrong more than 60% of the time. It has no predictive value.

And so you can see the wisdom of John Kenneth Galbraith's admonition that the only function of economic forecasting is to make astrology look respectable. Now, just because we can't predict the short-term outlook for the market or interest rates, doesn't mean we can't prepare. And an important part of our job as investors is recognizing where we are to begin with, and then looking at how we structure the portfolios to weather the inevitable storms that will come.

Because after all over a long-term investor horizon, there are going to be times of recession and there are going to be times of expansion. There are going to be times of falling interest rates and rising interest rates. There are going to be times of relative stability and also times of disruption. So knowing this, the important question doesn't become when to invest, is now a good time to invest, it becomes how to invest. How to invest knowing that there is inherent uncertainty, always, in the short-term outlook. Well, this understanding shapes all of the decisions we make when we structure our portfolios here at Davis Advisors.

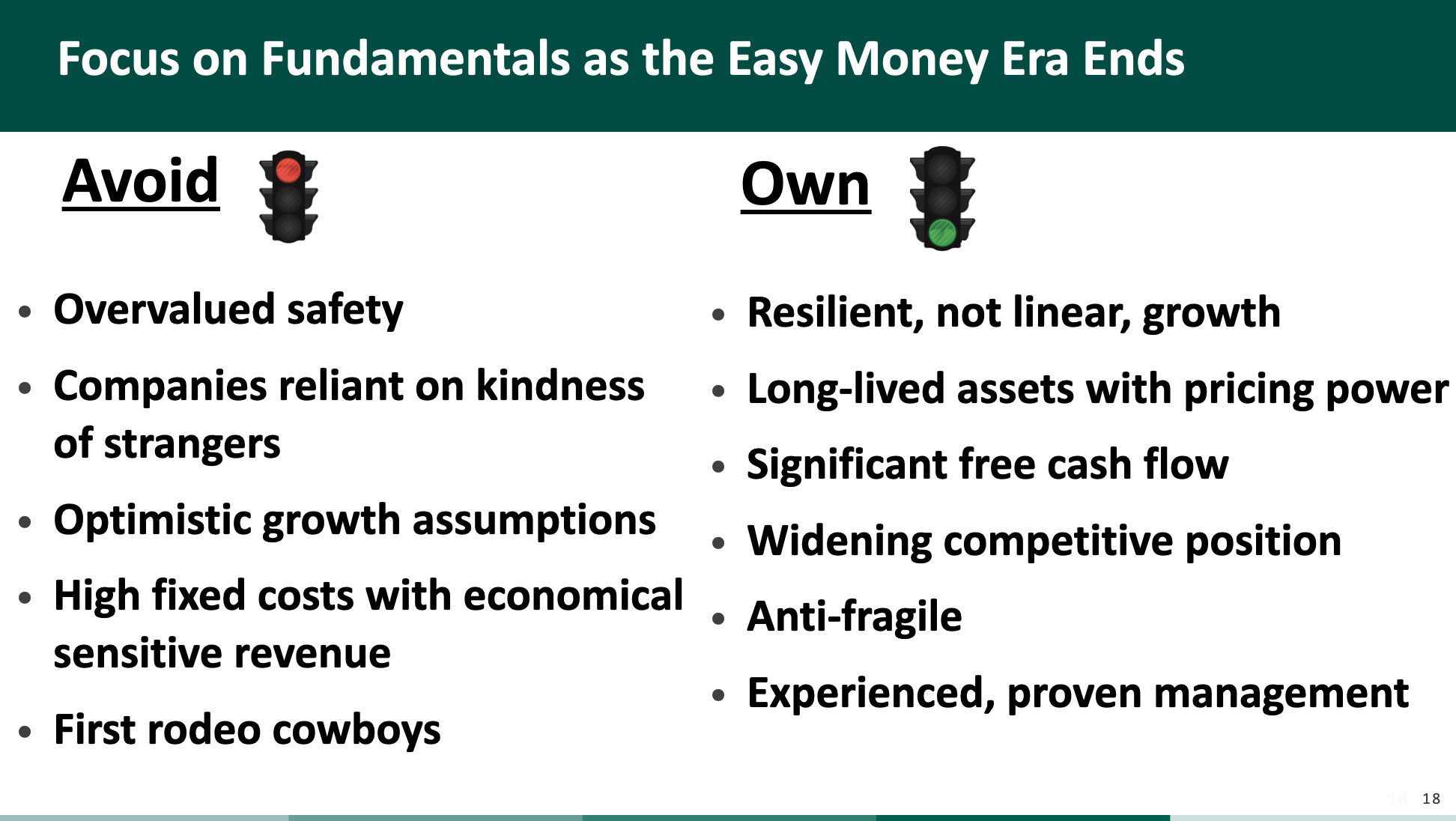

We look through at the characteristics of the underlying businesses to see if they will have the ability not just to weather storms but also to make progress when times are good. So we look for characteristics like resiliency and financial strength, adaptability, durability, and even the flexibility of management to be able to adapt to changing times.

Putting these things together, recognizing that the future is inherently uncertain, we can still face it with confidence, knowing that the sorts of companies we own are prepared for all different eventualities.

More Videos

The Davis Select Worldwide ETF (DWLD)

Why Investors Should Disregard Short-Term Forecasts