Key Takeaways

- Davis Select U.S. Equity ETF (DUSA) returned +9.96% in the first half of 2025 vs. +6.20% for the S&P 500 Index. The fund has consistently grown wealth for shareholders since its inception.

- This performance comes during a period of transition across three fronts—economics, technology and geopolitics—which we discuss in detail below. These transitions, coupled with high valuations and market concentration, create an environment of heightened risk, volatility and disruption.

- However, our investment discipline is being rewarded. Our portfolio is made up of companies with resilient growth, durable earnings power, significant free cash flow and some combination of long-lived assets, pricing power, competitive advantage, balance sheet strength, proven management and attractive valuation.

- Our focus on businesses with long-term growth and low valuations, instead of the high valuations and unprecedented concentration of the equity indices, positions us to reward long-term shareholders who have resisted chasing the fads and fashions of the last decade.

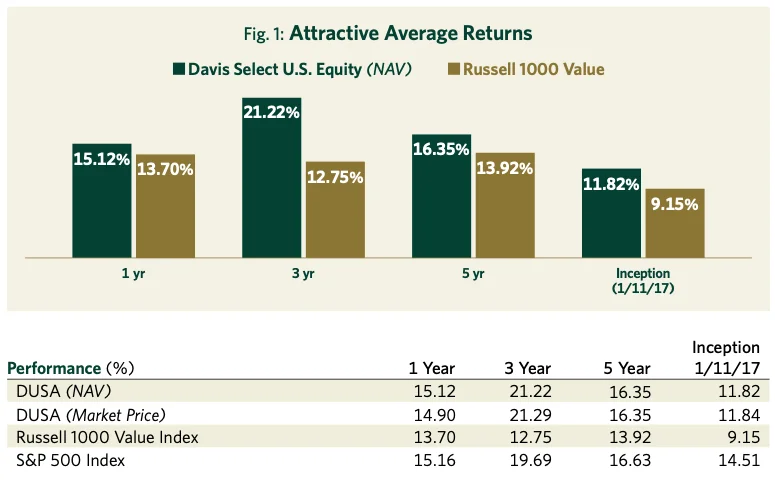

The average annual total returns for Davis Select U.S. Equity ETF for periods ending June 30, 2025, are: NAV Return, 1 year, 15.12%; 5 years, 16.35%; Inception (1/11/17), 11.82%; Market Price Return, 1 year, 14.90%; 5 years, 16.35%; Inception, 11.84%. The performance presented represents past performance and is not a guarantee of future results. Investment return and principal value will vary so that, when redeemed, an investor’s shares may be worth more or less than their original cost. For the Fund’s most recent month end performance, visit www.davisetfs.com or call 800-279-0279. Current performance may be lower or higher than the performance quoted. NAV prices are used to calculate market price performance prior to the date when the Fund was first publicly traded. Market performance is determined using the closing price at 4:00 pm Eastern time, when the NAV is typically calculated. Market performance does not represent the returns you would receive if you traded shares at other times. The total annual operating expense ratio as of the most recent prospectus was 0.59%. The total annual operating expense ratio may vary in future years.

This material includes candid statements and observations regarding investment strategies, individual securities, and economic and market conditions; however, there is no guarantee that these statements, opinions or forecasts will prove to be correct. All fund performance discussed within this material are at NAV and are as of 6/30/25, unless otherwise noted. This is not a recommendation to buy, sell or hold any specific security. Past performance is not a guarantee of future results. The Attractive Growth and Undervalued reference in this material relates to underlying characteristics of the portfolio holdings. There is no guarantee that the Fund performance will be positive as equity markets are volatile and an investor may lose money.

Performance:

Building Long-Term Wealth

Davis Select U.S. Equity ETF (DUSA) returned +9.96% in the six months ended June 30, 2025, and has grown wealth for shareholders since its inception. The longer a shareholder has been invested in the fund, the more their savings have grown (see Figure 1).

Outlook:

Triple Transition and Market Complacency equals Growing Risks and Select Opportunities

The triple transitions of economic, technological and geopolitical transformation paired with a complacent and concentrated market may lead to greater risk and a shrinking opportunity set. Because of this combination, our investment discipline remains laser-focused on identifying durable undervalued businesses within a narrow and selective opportunity set. Our selective process leads us to reject roughly nine out of 10 companies in the S&P 500 Index.

Over the last three years when each of these transitions began in earnest, our fundamental analysis and selectivity have been rewarded with strong absolute results and relative outperformance of the S&P 500 Index. Meanwhile, in this fast-changing landscape, former safe havens and past market darlings have become more perilous. We are well-positioned for this environment and gratified that the investors who stood firm through a decade in which our discipline was out of favor are now being rewarded.

Economic Transition: The End of the Free-Money Era

Beginning with the financial crisis of 2008–2009 and continuing through March 2022, many of the tenets of sound investing seemed to become irrelevant. In the U.S., interest rate suppression (both directly and indirectly through a bond purchase program known as quantitative easing), accompanied by dramatic increases in government spending and ballooning Federal deficits, became a matter of national policy. As the cost of money approached zero despite huge increases in money supply, these policies created significant market distortions. Assets were mispriced, risks ignored, inflation allowed to metastasize, and valuation discipline penalized. After more than a decade of these distortions, the shift to a more normal environment began in March 2022 when the U.S. Federal Reserve recognized the reality of inflation and announced the first of 11 consecutive increases in the Federal funds benchmark rate.

Given the sheer magnitude of the distortions created in the free-money era, the great unwinding that began in 2022 likely still has a long way to go. As liquidity and credit get repriced, strains in levered asset classes such as commercial real estate, private equity and other so-called alternative assets are likely just the beginning.

Investors should be prepared for unexpected disruptions and heightened volatility. Although the trigger may be unknowable, the high valuations of many of today’s market darlings rest on extremely rosy assumptions which could change quickly should the market’s current optimism be undercut by the unpleasant appearance of one or more so-called black swans, inevitable but unpredictable shocks to the system. As for the short term, while we expect further interest rate cuts later this year, we remain concerned that by far the greater risks investors face today are still inflation and speculation.

Technological Transition: AI and Its Implications

In addition to an economic transition, technological disruption is also creating significant changes in the investment landscape as investors grapple with the implications of generative artificial intelligence, or so-called GenAI. While we are naturally skeptical of hype, we must begin by stating unequivocally that GenAI is likely to be the most transformational technological development in modern history, driving major advances across numerous industries while creating significant new competitive, economic and social risks.

Like politics, discussions about AI often devolve into extreme camps. On one side, the optimists highlight that AI will generate unprecedented gains in productivity, economic growth and innovation, leading to vast improvements in sustainable energy, human longevity and quality of life. On the other hand, the pessimists warn that such gains in productivity and innovation will lead to soaring unemployment (particularly in white collar industries where it is estimated that 50% of entry-level jobs will be eliminated within five years), and that the power of AI will be exploited by terrorists and autocrats alike before eventually turning on humanity itself.

In a polarized time, our job is not to be optimistic or pessimistic but rather realistic and adaptable. Looking at the world through this lens, we know that the market for AI products and services is still in its very early days and competition is fierce. At such times, we believe it is very risky to project who the long-term winners and losers will be based on their past one or two years of performance. For example, the substantial technological and societal transformations heralded by the internet in the 1990s culminated in the dot-com bubble and subsequent crash. As our friend Bill Nygren, portfolio manager at Oakmark Funds, noted: “In 2000, amidst ‘dotcom’ hysteria, the largest cap Internet companies were Cisco, America Online and Yahoo!. AOL and Yahoo! ended up nearly worthless, and Cisco … has lost 80% relative to the S&P 500 Index. We think these results should give pause to anyone believing the AI winners have already been determined.”1

AI is also likely to prove disruptive to once stable industries in ways that are difficult to anticipate. As one observer noted recently, “when the iPhone was invented, flashlight makers were not worried.” Many companies that have long been considered reliable safe havens or growth darlings are vulnerable to disruption as technology changes business models and consumer behavior. This type of disruption is likely to penalize both momentum investors who, by definition, assume past trends will continue, as well as risk-averse value investors who may wrongly flock to former safe havens in the service and consumer sectors before realizing that they are as prone to AI disruption as manufacturers once were to globalization. However, within this disruptive environment, there is no doubt that opportunities will present themselves to research-driven investors like us who are willing to be highly selective and open-minded.

Geopolitical Transition: Economic Nationalism and Global Uncertainty

Geopolitical disruption is the third transition shaping the investment environment as economic nationalism and protectionism replace free trade and globalization. The prospect of higher labor costs, inconsistent trade policies and increasing global conflict create unpredictability and economic strain. At such times, characteristics like durability, resiliency and adaptability will be more important than ever. Our focus on selecting companies that embody these characteristics may well be a tailwind in the decade ahead as investors come to recognize increasing fragility in a period of economic, technological and geopolitical transition.

Complacency, Risk and Select Opportunities

Typically, in an investment environment characterized by transition and uncertainty, markets trade at low valuations. Today’s uncertainty, however, has been met with a complacency bordering on denial. Fortunately, in the face of an extremely richly valued and concentrated market, we have put together a very selective portfolio of companies that combine attractive growth with low valuations, a combination we call a value investor’s dream. As shown in Figure 2, our dramatic differentiation from the market allows us to be simultaneously wary of the S&P 500 Index, which is trading at multiples significantly above the historic average, and optimistic for our selective portfolio of companies which trades at a 39% discount to the index while growing earnings meaningfully faster than the index portfolio.

Fig. 2: Selective, Attractive Growth, Undervalued2

| DUSA | Index | |

|---|---|---|

| Holdings | 28 | 503 |

| EPS Growth (5 Year) | 22.0% | 15.1% |

| P/E (Forward) | 14.1x | 23.1x |

Before turning to the details of our portfolio, however, it is worth unpacking the complacency and risk we see in the high valuation and concentration of the indices at today’s levels. Several metrics give a good picture of the risk we see in the averages and the opportunity these risks create for our portfolio.

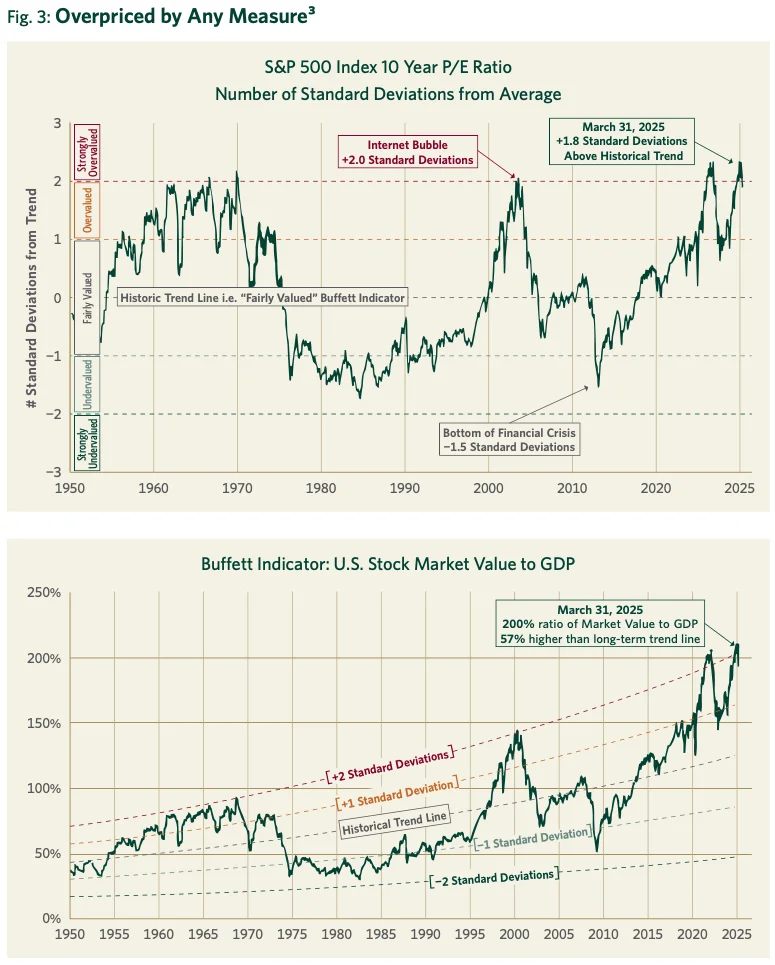

Record High Valuations

In terms of valuation, as can be seen in Figure 3, the P/E ratio of the S&P 500 Index at the end of March 2025 was almost two standard deviations above its historic average. At the same time, U.S. stock market value as a percentage of our total GDP (a ratio often referred to as the “Buffett Indicator” in honor of Warren Buffett who described it as one of the best long-term indicators of the relative attractiveness of stocks) was at its highest level in history.

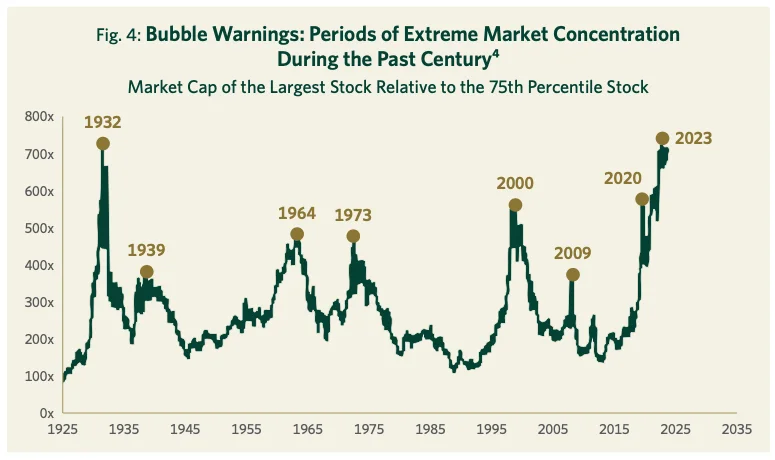

Unprecedented Concentration

In terms of concentration, a handful of the largest companies represent an unprecedented concentration risk within the richly valued market averages. As with the charts above, such concentration has tended to be a warning sign of a stock market bubble, as shown in Figure 4.

Portfolio Positioning:

Selective, Attractive Growth and Undervalued

Because we have steadfastly adhered to our long-term valuation discipline, for us the unwinding of the free-money bubble is an overdue but unsettling return to normalcy after more than a decade of delusion. As we return to reality and prepare for more volatile times, we are encouraged that the companies we own (including our carefully selected banks) are well-positioned for this changing environment. Investors are once again seeking durability, profitability, cash production, valuation and balance sheet strength. These characteristics are becoming increasingly desirable because they allow companies to better navigate a period of transition and uncertainty. While this transition may create headwinds for many of the market darlings that led for so long, it may simultaneously create tailwinds for the type of durable, attractively valued businesses that lie at the heart of our investment discipline, finally rewarding the patience of our long-term clients.

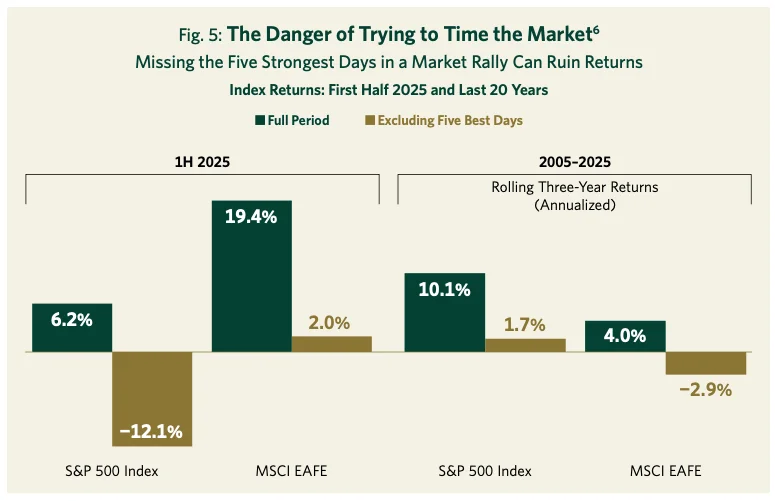

Our conviction includes the recognition that short-term corrections and surprises are an unpleasant but inevitable part of the investment landscape. History shows that investors should expect a 10% correction on average once per year and a 20% correction every 3.5 years. The first half of this year was a dramatic case in point. Casual investors who only check their 401k balance on occasion might be forgiven for concluding that it was an uneventful six months culminating with a decent return. The reality of course is far different: in addition to geopolitical gyrations and volatility in the U.S. Treasury bond market, the S&P 500 Index fell nearly 20% from its February peak to its April trough. After this swoon, the media was filled with stories of a new bear market with one pundit claiming on CNBC, “the past week's price action screams ‘bear market’ to us…” However, from these lows, the market is up almost 25%, reinforcing the importance of staying the course through times of volatility.

To bring home the importance of staying the course, Figure 5 quantifies the dramatically lower returns an investor would have earned by missing out on the five best days of a given period. The section headed “1H 2025” shows that investors would have lagged the market return (represented by the S&P 500 Index) by a staggering 18.3 percentage points if they had missed only five days in the first half of 2025. The section of the chart entitled “2005–2025” makes clear that 2025 is not an isolated or anomalous period. Looking back over all rolling three-year periods between 2005–2025, an investor who missed the five best days would have given up more than eight percentage points per year in returns vs. one who held steady. This dramatic data reinforces the timeless wisdom of famed investor Peter Lynch who warned that “far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”5

Portfolio Themes and Holdings

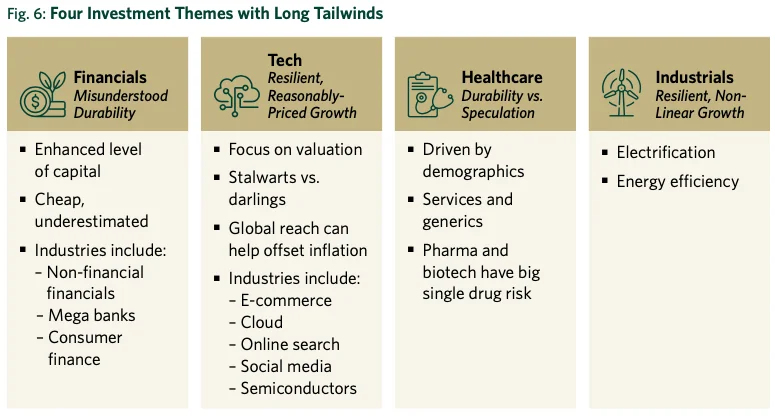

While we build our portfolios from the bottom up based on company-by-company research rather than top-down trends, most of the attractively valued and durable businesses we own reflect four overarching, long-term themes (see Figure 6).

Financials: Misunderstood Durability

Financial companies represent the largest sector weighting in DUSA and reflect a theme we describe as “Misunderstood Durability.” Since the 2008–2009 Global Financial Crisis (GFC), investor sentiment has tended to view financial companies in general and banks in particular as fragile, volatile and prone to disaster. This perception is understandable but inaccurate with regards to the select banks we own, such as Capital One, Wells Fargo and U.S. Bancorp all of which grew their customer bases through both the GFC and the regional banking crisis of 2023. A combination of higher capital ratios, larger market shares and tighter regulation have reduced the riskiness of these well-run institutions while increasing their durability and competitive advantages. Their quarterly and even annual earnings can be volatile, but such “lumpiness” does not diminish the fact that these companies generate capital throughout the business cycle at an attractive rate and use this capital to increase shareholder value by steadily raising dividends and buying shares at discounted prices. Finally, while AI creates some long-term risks for traditional banking services, in the short and medium terms, the combination of regulation and large upfront IT spending requirements should advantage the big, well-managed banks we own, giving them significantly lower costs than their regional competitors.

Technology: Resilient, Reasonably-Priced Growth

Technology, broadly defined, makes up the portfolio’s next largest theme. As with financials, the term technology covers a broad range of companies with diverse types of business models. Within the tech universe, we focus on a select few companies that combine proven long-term growth with reasonable valuations. This valuation discipline has led us to avoid many of the market darlings that have driven the S&P 500 Index in recent years, including most of the so-called Magnificent Seven tech darlings that today represent an unprecedented concentration of almost 35% of the S&P 500 Index’s market capitalization.7

In fact, while others have been piling into companies like Meta and Alphabet, which we have owned for many years, we have used their recent outperformance in recent years as an opportunity to significantly reduce our positions in these excellent, but richly valued, companies. Instead of market darlings such as Nvidia, Apple or Tesla, our technology investments have been focused on durable, proven but less glamorous parts of the technology sector such as capital equipment (Applied Materials) and retail and cloud-hosting infrastructure (Amazon).

As we discussed earlier, all investments (not just those in the technology sector) are likely to be affected by the much-heralded breakthroughs in artificial intelligence. In preparing for this impact, investors should bear in mind Roy Amara’s famous law: “We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run.”8 As with the internet, our approach is to avoid the “story stocks” and instead ask which companies can use this powerful new tool most effectively to build the value of their businesses and, just as importantly, which companies are most threatened by the new technology. While AI stocks will likely go through booms and busts, the underlying technology is transformational and seems certain to be a permanent part of the economic landscape going forward. As such, questions about its impact are already a standard part of our research process.

Healthcare: Durability vs. Speculation

For decades, healthcare spending relentlessly rose from 5% of U.S. GDP in 1960 to roughly 17% in 2010. However, reflecting the wisdom of Herb Stein’s famous observation that “if something cannot go on forever, it will stop,”9 the rollout of the Affordable Care Act in 2010, along with a range of other public and private initiatives, has led to a flattening of this growth since then. Today, while healthcare spending remains a political hot button, it is somewhat encouraging that 15 years later, its percentage of GDP still stands around 17% despite the invention of many expensive new therapies in the interim. To offset the rising costs of novel treatments and innovative (and patented) pharmaceutical therapies, the healthcare system has needed to constantly find savings elsewhere. As a result, our investments in this important sector have tended to avoid pharmaceutical and biotech companies that may rely on high prices to recoup costs and instead focus on areas such as generic drug manufacturers (Viatris) and hospital product companies (Solventum). Historically, we have also made several profitable long-term investments in the health insurance area. As companies in this controversial sector have swooned under recent scrutiny, investors have been fleeing the sector, driving many companies’ stock prices down more than 50%. While we acknowledge today’s risks, we also see no practical alternative to the employer-paid system of health insurance in this country. As a result, previous experience has taught us that such periods of controversy (including those experienced under both the Clinton and Obama administrations) often create good entry points into these dominant companies. As a result, we have initiated a position in UnitedHealth which joins our holdings in CVS and Humana.

Industrials: Resilient, Non-Linear Growth

In an age of digitization, software, AI, content creation, advertising, and hot consumer brands, companies that operate railroads and generate electricity (Berkshire Hathaway), extract copper (Teck Resources), manufacture insulation (Owens Corning), raise food (Tyson) or produce energy (Tourmaline Oil) may sound dull, but our civilization cannot function without their products. The necessity of these products and, in many cases, the environmental risks of producing them, create regulatory and legal complexity. Their production often requires large upfront capital investment. In any short-term period, their demand and supply may be subject to cyclical swings, resulting in earnings volatility for producers. Further, as such products are not especially differentiated, price and availability are often the only drivers of customer preference, making it difficult for any one company to maintain high returns without attracting new competition.

So how do we find attractive opportunities in such a difficult category? First, because many such dull businesses are overlooked and out of favor in today’s growth-driven market, carefully selected industrials currently sell at extremely low valuations. This is despite their having long-term records of growth, durable earnings power and competitive advantages driven by low-cost assets or economies of scale, and some inflation protection due to long-lived assets. What’s more, certain long-term trends may be accelerating the growth rates of a number of these companies. For example, in a world of massively expanding computing power, the need for electricity is markedly accelerating. Trends like electrification of automobiles and expansion of the electricity grid increase copper demand at a rate that is likely to continue to outstrip growth in supply (a byproduct of the enormous regulatory challenges of permitting and building new mines).

Finally, in ways that are hard to anticipate, the advent of AI discussed earlier is almost certain to create enormous disruptions in many white-collar service industries in much the same way that automation and globalization impacted U.S. manufacturing and blue-collar workers in the 1980s and 1990s. As the services sector faces significant uncertainty in the years ahead, people may be more enthusiastic about our industrial holdings with their low valuations, dull business models and resistance to obsolescence.

One last holding that bears mention fits the description of resilient, nonlinear growth but is not an industrial. The company is MGM Resorts International. While casinos may not seem to have a lot in common with things that move, warm or feed us, gambling is also a timeless, human urge. Within this durable sector, MGM is the premier global company, commanding approximately 40% of the casinos on the Las Vegas strip, a powerful position in Macau and, expected before the end of this decade, a monopoly on gambling in Japan.

Looking Ahead:

A Turning Tide

After a long stretch in which our investment discipline was out of favor, we see many indications that the tide is turning. The current combination of economic, technological and geopolitical transitions bodes poorly for momentum investors/trend followers, while high market valuations and extreme concentration bode poorly for the major stock indices and passive investors. In contrast, our highly selective approach and proven long-term investment discipline is becoming more important than ever.

While we expect periods of volatility and disruption as we navigate this time of triple transition, the combination of above-average growth and below-average valuations that characterizes our portfolio today is rare. It positions us well to reward investors who resisted the bandwagon’s siren song and held fast to our patient, long-term approach to building generational wealth. The key pillars of success in this tumultuous environment are the cornerstones of our investment discipline and selection criteria: cash generation, conservative capital structure, durable business model, low valuation and proven, adaptable management.

For more than 50 years we have navigated a constantly changing investment landscape guided by one North Star: to grow the value of the funds entrusted to us. We are pleased to have achieved strong results thus far and look forward to the decades ahead. With more than $2 billion of our own money invested in our portfolios, we stand shoulder to shoulder with our clients on this long journey.10 We are grateful for your trust and are well-positioned for the future.

DUSA Davis Select U.S. Equity ETF

Semi-Annual Review 2025

Managers